In recognition of Earth Day’s 55th anniversary, celebrated under the theme “Our Planet, Our Power,” Clarity AI has released new data analyzing global renewable energy consumption and its impact on emissions reduction. The report examines trends since 2020 in renewable energy usage among MSCI ACWI companies headquartered in the top 10 countries for renewable energy generation.

The findings reveal that while renewable energy adoption has grown significantly in many countries, progress remains limited across several high-emission sectors that are difficult to electrify. As a result, meeting the global Earth Day target of tripling renewable energy generation by 2030, in line with Sustainable Development Goal 7 on affordable and clean energy, will require not only expanded capacity, but also accelerated efforts to enable uptake across all sectors, especially the most carbon-intensive.

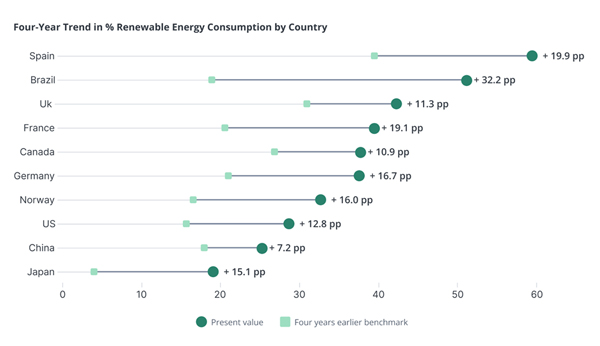

Brazil shows the most progress, while Spanish companies lead in renewable energy usage

Companies headquartered in Brazil have made remarkable strides. Since 2020, Brazilian companies have increased their use of renewable energy by 32 percentage points, rising from 19% to 51%. As the host of this year’s COP30, Brazil now boasts the second-highest share of renewable energy use among companies analyzed.

Spanish companies currently lead in overall usage, with renewable energy making up nearly 60% of their total consumption. Since 2020, Spain has increased its share from 40% to 60%, reflecting a gain of around 20 percentage points.

In the United States, companies are moving in the right direction and accelerating the transition toward a cleaner energy future. However, the current 29% renewable energy share remains insufficient in the context of global decarbonization goals.

By contrast, progress has been far more limited in traditionally fossil-fuel-dependent economies such as China. There, corporate renewable energy use has grown by just 7 percentage points since 2020 — a concerningly slow rate, especially when coupled with ongoing challenges in industrial electrification.

The figure shows the average consumption of renewable energy, based on companies from the MSCI ACWI headquartered there. For the four-year analysis, data from 2020 and 2024 is used; if unavailable, data from 2019 and 2023 serves as the alternative basis. Source: Clarity AI. Data as of April 8, 2025.

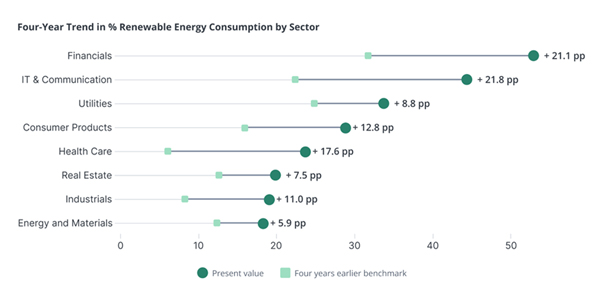

Electrifiable sectors excel; heavy industries lag

At the sector level, the contrast becomes even more striking among the companies headquartered in the countries analyzed. Financial services and the IT & communications sector—both highly electrifiable and largely powered through the electric grid—have nearly doubled their renewable energy use since 2020. The financial sector rose from 32% to over 53%, while IT & communications increased from 23% to almost 45%. These sectors demonstrate that when electrification is technically feasible, the transition to renewables can happen swiftly and efficiently.

In contrast, energy-intensive sectors, such as fossil fuels materials, industrials, and real estate, have made far slower progress due to their dependence on direct fuel inputs for heating and industrial processes, which are much harder to electrify. For example, the fossil fuels and materials sectors increased their renewable energy use only modestly, from 12% to 18%. The real estate sector rose from 13% to 20% over the same period.

The figure shows the average consumption of renewable energy for each sector, based on companies from the MSCI ACWI headquartered there. We use the “Energy” sector from GICS, which encompasses fossil fuel generation, oil and gas activities, and coal and consumable fuels. For the four-year analysis, data from 2020 and 2024 is used; if unavailable, data from 2019 and 2023 serves as the alternative basis. Source: Clarity AI. Data as of April 8, 2025.

“These industries are structurally more challenging to decarbonize, yet are critical for achieving net-zero emissions by 2050, as they account for 75% of global emissions”, stated Andrés Olivares, Senior Manager of Product Research and Innovation at Clarity AI. “Without substantial investment in infrastructure and electrification technologies, the global ambition of a net-zero economy will remain out of reach.”

This call for infrastructure and electrification is gaining momentum across policy arenas. For instance, prior to the new European Commission taking office last December, President Ursula von der Leyen emphasized in her mission letter the creation of a unified European Grids Plan—aimed at upgrading and expanding transmission networks to support rapid electrification. However, no matter how quickly renewables are scaled, near-term clean energy supply bottlenecks are likely. Currently, electricity accounts for only around one-third of the energy mix in European industry[1]—a share that must grow significantly to meet climate goals. The challenge is similar in the United States, where electricity represents just over 20% of the energy mix, while oil products still account for 47% of total energy consumption[2].

“As a global community, we’re progressing, but the data shows we’re only halfway there,” added Olivares. “Generating more clean energy isn't enough if we want to achieve the necessary emissions reductions. We need to develop the infrastructure to use it effectively, especially in the most energy-intensive sectors. Powering the Earth differently is not enough. We must also build it to run differently.”

For more information, please visit: https://clarity.ai/