Deal activity (mergers & acquisitions (M&A), private equity (PE), and venture capital (VC) financing deals) across the Asia-Pacific (APAC) region reported a 4.3% decline in October 2021, primarily due to a nosedive in PE/VC deals and decline in the overall deal volume across big markets China and India, according to GlobalData, a leading data and analytics company.

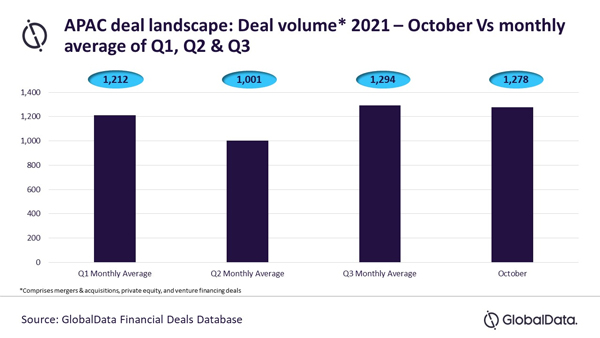

An analysis of GlobalData’s Financial Deals Database reveals that a total of 1,278 deals were announced in APAC region during October 2021 compared to 1,336 deals during the previous month.

Notably, the deal volume during the month was lesser than the monthly average of Q3 2021 but higher when compared to the monthly average of Q1 and Q2.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Deal activity in the APAC region has been consistently improving since June. However, October reversed the trend with surge in new COVID-19 cases across key markets such as China impacting the deal-making sentiments.”

New Zealand, Japan, Malaysia and South Korea witnessed month-on-month growth in deal volume by 23.8%, 23.1%, 16.7% and 4%, respectively, in October 2021.

In contrast, big markets such as China and India reported month-on-month decline in deal volume by 5.8% and 11.6%, respectively, during the month. Other markets such as Singapore, Indonesia and Australia also witnessed month-on-month decline in deal volume.

Key deal types such as private equity and venture financing deals witnessed 33.8% and 6.7% decline in deal volume in October 2021 compared to the previous month, respectively while the number of M&A deals increased by 3.9%.

Bose concludes: “Deal activity in the region remained inconsistent ever since the COVID-19 pandemic started playing havoc with markets. Although some countries are showing improvement in deal-making sentiments, market conditions still remain volatile in some of the key markets such as China and India.”