We're delighted to announce the launch of our Q3 2024 Outlook Report. In this report, we reflect on the macroeconomic landscape of 2023, exploring emerging trends and potential shifts as we transition into the next year - from the rise of institutional AUM and crypto volumes to changes in the centralised exchange landscape, the emergence of tokenisation, DeFi activity and much more.

Overall, 2023 has been a pivotal year for digital assets, marked by a surge in institutional adoption, regulatory progress, and numerous technological advancements. Ripple's legal victory, the rise of spot Bitcoin ETFs, the EU's MiCA framework, and the adoption of tokenisation, highlight not just a changing sentiment towards digital assets, but also demonstrate the increasing attention and involvement from institutional players. Continue reading below as we highlight the top trends of the year, and what to expect in 2024.

Crypto & Bitcoin Experience Notable Comeback in 2023

The fourth quarter of 2022 was a pivotal moment for digital assets, marked by the collapse of FTX and subsequent scrutiny of the industry. Despite this, Bitcoin (BTC) and the wider digital asset industry showed resilience from the start of 2023, with BTC posting impressive returns of 156% YTD, outperforming other notable assets.

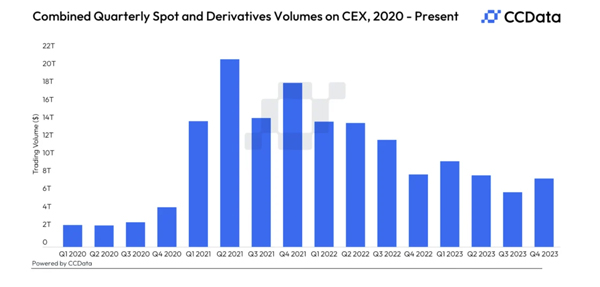

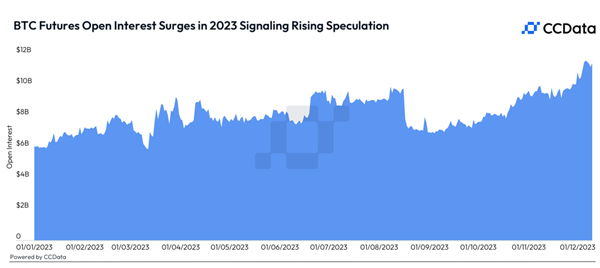

There has also been a noticeable uptick in speculative activities, as evidenced by the record-high open interest in futures and options on centralised exchanges. This peak in speculative interest marks a significant trend in the market. In 2023, futures open interest on centralised exchanges rose from $6.07bn to $11.4bn, an increase of 87.8%.

The Institutionalisation of Digital Assets Continues

In 2023, the continued institutionalisation of the industry can be seen via CME, which is considered the top derivatives platform for institutions to speculate on BTC futures. In November, CME’s BTC open interest totalled $4.1bn, exceeding Binance’s $3.8bn OI figure to become the top derivatives exchange in the industry for the first time since October 2021 for BTC futures trading activity.

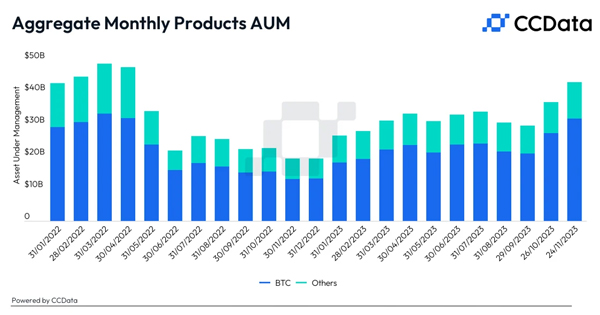

A clear uptrend can also be seen when looking at assets under management (AUMs) across popular crypto products. Out of twelve monthly periods, ten demonstrated MoM gains. YTD, aggregated AUMs have grown by more than 150%, from $19bn at the end of December 2022 to $49bn as of the 10th of December

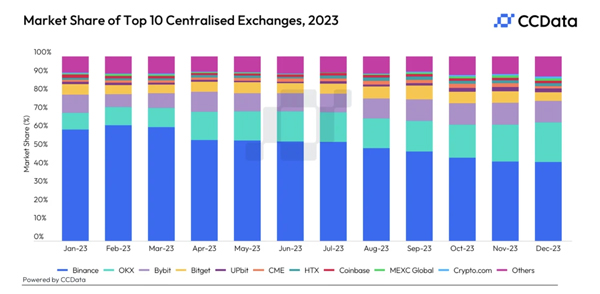

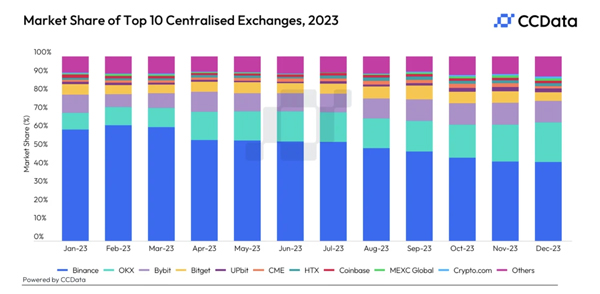

The centralised exchange landscape has seen large structural shifts in 2023. There was a trend in the consolidation of the market share to Binance, following the collapse of FTX. However, upon reaching an all-time high market share of 62.6% in February, Binance’s dominance has since waned, falling for 10 consecutive months to 42.7% - its lowest since February 2022. OKX and Bybit have been the two largest beneficiaries of Binance’s decline, partly due to their strong position in the derivatives market.

CCData is an FCA-authorised benchmark administrator and global leader in digital asset data, providing institutional-grade digital asset data and settlement indices. By aggregating and analysing tick data from globally recognised exchanges and seamlessly integrating multiple datasets, CCData provides a comprehensive and granular overview of the market across trade, derivatives, order book, historical, social and blockchain data.