In June, the combined spot and derivatives trading volume on centralised exchanges rose 14.2% to $2.71tn, the first monthly increase in trading volume since March. The increase in trading volumes can be attributed to the optimism in the market following the filing of spot Bitcoin ETFs by the largest asset manager in the world, BlackRock, and other US TradFi companies last month.

Download the full report here.

Key takeaways:

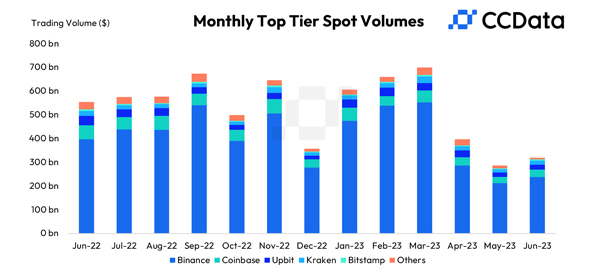

- In June, spot trading volume on centralised exchanges rose 16.4% to $575bn, recording the first increase in three months. However, spot trading volumes on centralised exchanges remain at historically low levels, recording the lowest quarterly volumes since Q4 2019.

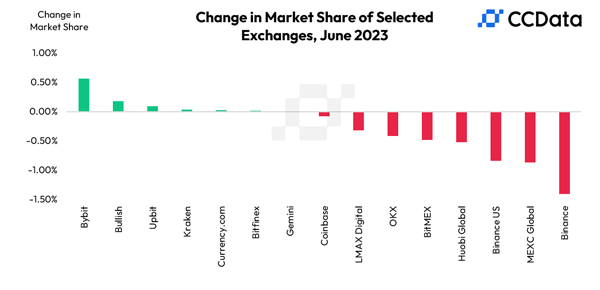

- Binance’s spot trading market share has declined for the fourth consecutive month, falling to 41.6% in June. This is the lowest market share for the exchange since August 2022. Its derivatives market share also declined for the fourth consecutive month, falling to 56.8% in June, its lowest market share since October 2022.

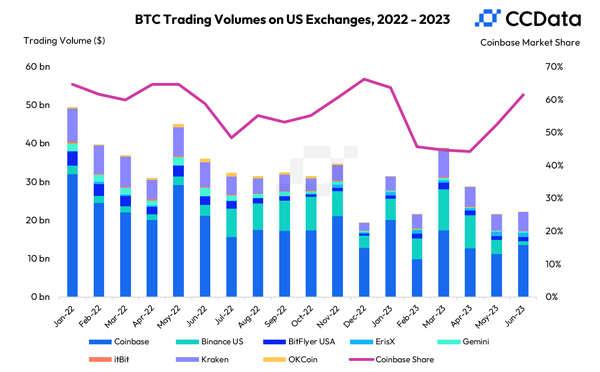

- Coinbase currently represents 61% of the Bitcoin trading volumes among exchanges registered in the US and is on track to increase its market share in the region for the third consecutive month (as of July 4th). However, based on June monthly trading volumes, US exchanges only represent 9.49% of the total BTC trading volumes, Coinbase currently accounts for 5.83% of global BTC volume.

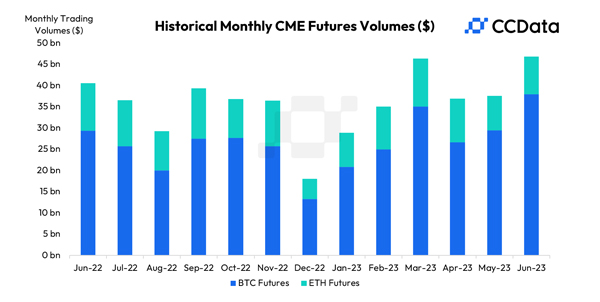

- In June, the total derivatives volume traded on the CME exchange rose 23.6% to $48.3bn. Institutional interest was particularly prevalent in BTC futures, with volumes rising 28.6% to $37.9bn, the highest volume on the exchange since November 2021.

- Derivatives trading volume on centralised exchanges rose 13.7% to $2.13tn in June, the first increase in derivatives volume in three months. However, the market share of derivatives trading on centralised exchanges declined for the first time in four months, falling to 78.7% in June from its previous all-time high of 79.1% in May.

Spot Volumes Rise For First Time in 3 Months, Yet Remain At Historically Low Level

In June, spot trading volume on centralised exchanges rose 16.4% to $575bn, recording the first increase in three months. The increase in volatility following the SEC’s lawsuit against Binance US and Coinbase, and the positive outlook in the market following the filing of spot Bitcoin ETFs by the likes of BlackRock and Fidelity, have contributed to an increase in trading activity last month.

However, spot trading volumes on centralised exchanges remain at historically low levels, recording the lowest quarterly volumes since Q4 of 2019.

Spot Bitcoin ETF Applications, While Coinbase Dominates US Bitcoin Volumes

Coinbase currently represents 61% of the Bitcoin trading volumes among exchanges registered in the US and is on track to increase its market share in the region for the third consecutive month (data as of July 4th). However, based on the monthly trading volumes in June, the US exchanges only represent 9.49% of the total BTC trading volumes and Coinbase accounts for 5.83% of the global BTC trading volumes.

Binance's Spot & Derivatives Market Share Drops to Multi-Month Low

Binance's position in the crypto market has weakened as its spot trading market share fell to 41.6% in June, marking its lowest since August 2022 and the fourth consecutive month of decline. Similarly, its derivatives market share also slid for the fourth month in a row, settling at 57.4%.

Despite this, Binance remains the largest venue for derivatives trading in crypto with $1.21tn in volumes. OKX, currently the second-largest derivatives platform, recorded a 44.9% surge in its trading volumes to $416bn in June, bringing its market share to 19.5%, its highest since April 2022.

CME Sees Significant June Rise in BTC Futures and Total Derivatives Volume

In June, the total derivatives volume traded on the CME exchange rose 23.6% to $48.3bn. Institutional interest was particularly prevalent in the BTC futures, with the volumes rising 28.6% to $37.9bn, the highest volume traded on the exchange since November 2021.

Comparatively, the ETH futures trading volume rose 9.93% to $8.91bn, while the ETH options trading volume fell 45.8% to $129mn.

The information provided by this report does not constitute any form of advice or recommendation by CCData. Any redistribution of charts appearing in this Review must cite CCData as the sole provider and creator.

About CCData

CCData is an FCA-authorised benchmark administrator and global leader in digital asset data, providing institutional-grade digital asset data and settlement indices. By aggregating and analysing tick data from globally recognised exchanges and seamlessly integrating multiple datasets, CCData provides a comprehensive and granular overview of the market across trade, derivatives, order book, historical, social and blockchain data.