CCData's latest Exchange Review is now available, providing readers with the key developments within the cryptocurrency exchange market. This includes analyses related to exchange volumes, crypto derivatives trading, market segmentation by exchange fee models, crypto-to-crypto vs fiat-to-crypto volumes, and more.

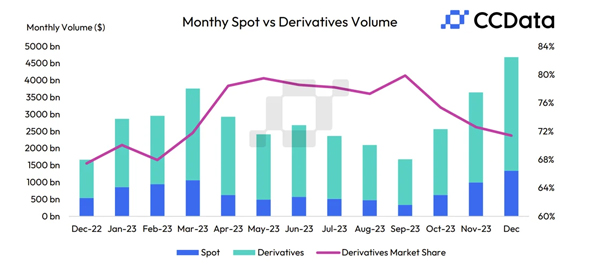

In December, the combined spot and derivatives trading volume on centralised exchanges increased for the third consecutive month, rising 28.4% to $4.68tn. This was the highest combined monthly trading volume recorded since June 2022. A key driver for this surge is market speculation surrounding the U.S. Securities and Exchange Commission's (SEC) impending decision on the spot Bitcoin ETF, which has contributed to heightened market volatility and increased trading volumes.

Key Findings:

- In December 2023, spot trading volumes surged to annual highs, marking the highest volume recorded since June 2022. During this period, spot volumes on centralised exchanges experienced a significant uptick for the third consecutive month, rising 34.0% to reach $1.3tn. Consequently, centralised exchanges reported a remarkable spot volume of $2.99tn in Q4 2023, a 125% increase from the lows recorded in Q3.

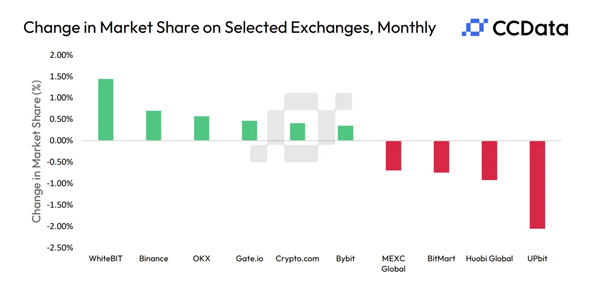

- Spot trading volumes on Binance rose 38.3% to $425bn in December, recording its first increase in market share in ten months. This marked the third consecutive month of growth for Binance and the highest monthly trading volumes since March 2023. As a result, its market share among centralised spot exchanges rose by 0.70% to 32.5%. Meanwhile, the derivatives trading volume on Binance rose 25.0% to $1.58tn, also recording the highest monthly volumes since March.

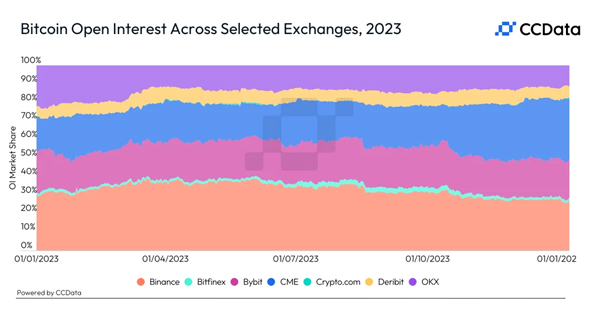

- Open interest in BTC Futures products traded on the CME continued to rise in December, increasing 17.5% to $4.83bn. After overtaking Binance as the leading venue for Bitcoin futures by open interest last month, the exchange extended its market share by 2.55%, rising to 31.6%, highlighting the increased institutional interest in the asset ahead of the anticipated launch of spot Bitcoin ETFs.

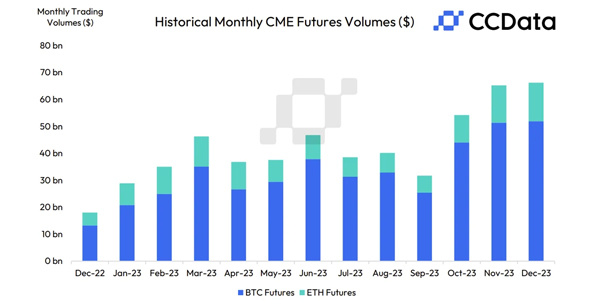

- Derivatives trading volume on the CME increased by 3.35% to $70.2bn, marking the highest volume since November 2021. Meanwhile, the trading volume for BTC Options surged by 85.9% to $2.24bn, suggesting that investors might be hedging their positions in anticipation of the upcoming spot Bitcoin ETF decision.

- In December, open interest on derivatives exchanges rebounded to yearly highs, climbing 13.1% to reach $26.8bn. The three largest derivatives exchanges — Binance, OKX, and Bybit — all experienced increases in open interest, with rises of 16.8%, 6.22%, and 18.4%, reaching $12.4bn, $4.47bn, and $7.87bn, respectively.

Trading Volumes Reach Yearly Highs for 2023 in December

In December, spot trading volumes on centralised exchanges rose for the third consecutive month, rising 34.0% to $1.34tn, recording the highest spot trading volumes since June 2022. As a result, centralised exchanges recorded a quarterly spot volume of $2.99tn in Q4 2023, an increase of 125% from the lows recorded in the previous quarter.

Meanwhile, derivatives trading volume on centralised exchanges rose 26.3% to $3.34tn, recording the highest monthly figures since December 2021. This was also the third consecutive month of increase in the derivatives volumes, indicating the increased level of speculation on the crypto assets as the markets edge towards the potential approval of a spot Bitcoin ETF in the US.

Binance Spot Market Share Rises for the First Time in Ten Months

Spot trading volumes on Binance rose 38.3% to $425bn in December, recording the third consecutive month of increase and the highest monthly trading volumes since March 2023. The market share of Binance among the spot centralised exchanges rose by 0.70% to 32.5%, recording the first increase in ten months.

The market share of the Binance, which began to decline in March 2023, has been softening in recent months. It has now started its recovery, recording its highest market share since September. Meanwhile, the derivatives trading volume on Binance rose 25.0% to $1.58tn, recording the highest monthly volumes since March 2023.

CME Derivatives Volumes Reach Highest Level Since Nov 2021

The derivatives trading volume on the CME exchange increased by 3.35% to $70.2bn, marking the highest volume since November 2021. BTC futures volumes on the exchange rose by 1.09% to $52.0bn, whereas the ETH futures volume on the exchange rose 3.20% to $14.3bn. Meanwhile, the trading volume for BTC Options surged by 85.9% to $2.24bn, suggesting that investors might be hedging their positions in anticipation of the upcoming spot Bitcoin ETFs decision.

Derivatives Exchange Open Interest Reaches Yearly Highs

The open interest of BTC Futures products traded on the CME continued to rise in December, increasing 17.5% to $4.83bn. After overtaking Binance as the leading venue for Bitcoin futures by open interest last month, the exchange extended its market share by 2.55%, rising to 31.6%, highlighting the increased institutional interest in the asset ahead of the anticipated launch of spot Bitcoin ETFs.

Meanwhile, the open interest on derivatives exchanges rebounded to yearly highs, climbing 13.1% to reach $26.8bn. The three largest derivatives exchanges by volume — Binance, OKX, and Bybit — all experienced increases in open interest, with rises of 16.8%, 6.22%, and 18.4%, reaching $12.4bn, $4.47bn, and $7.87bn, respectively.

CCData is an FCA-authorised benchmark administrator and global leader in digital asset data, providing institutional-grade digital asset data and settlement indices. By aggregating and analysing tick data from globally recognised exchanges and seamlessly integrating multiple datasets, CCData provides a comprehensive and granular overview of the market across trade, derivatives, order book, historical, social and blockchain data.

The information provided by this report does not constitute any form of advice or recommendation by CCData. Any redistribution of charts appearing in this Review must cite CCData as the sole provider and creator.