In March 2023, centralised exchanges experienced a significant increase in trading volumes, marking the third consecutive month of growth. This surge can be attributed to the turbulent market conditions, such as the collapse of USDC's banking partner Silicon Valley Bank, and the positive sentiment following market recovery.

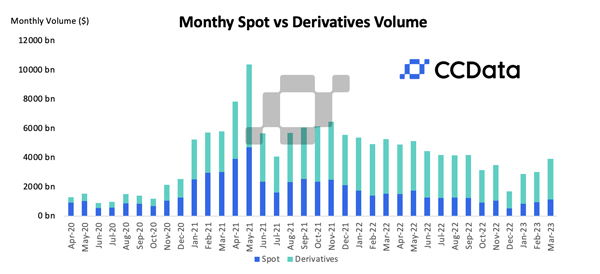

The combined spot and derivatives trading volume on centralised exchanges rose 25.9% to $3.81tn, recording the third consecutive month of increasing monthly trading volumes. Centralised exchanges also recorded the highest combined spot and derivatives volumes since September 2022.

Download the full report here.

Key takeaways:

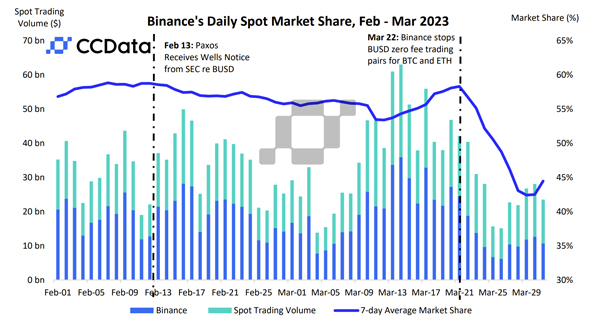

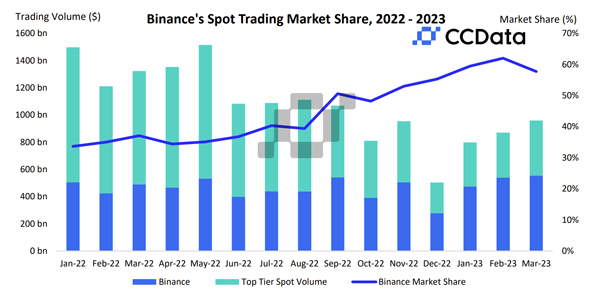

- Binance’s spot market share across top-tier exchanges fell for the first time in five months, decreasing from 62.0% in February to 57.7% in March. Meanwhile, Binance’s derivatives market share has continued to rise, recording an all-time high market share of 64.0% as of March.

- Spot trading volume on Binance rose 2.54% to $554bn, while its counterparts saw a significant increase with OKX and Coinbase registering a rise of 29.7% and 23.5% to $54.9bn and $49.3bn, respectively. Currently, Binance offers only zero-fee trading for BTC-TUSD and ETH-TUSD trading pairs.

- In March, the derivatives trading volume across centralised exchanges rose 32.6% to $2.77tn, the highest volume since September 2022. Meanwhile, the spot trading volume on centralised exchanges rose 10.8% to $1.04tn.

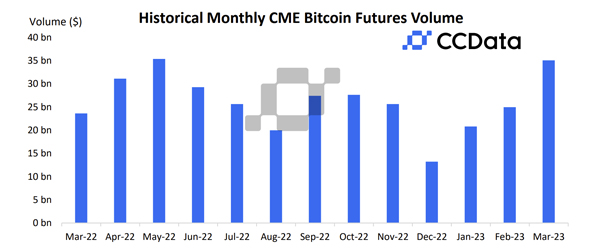

- In March, the total derivatives trading on CME (including futures and options) rose 34.5% to $48.8bn, the highest since January 2022. This recorded the third consecutive increase in volumes traded on CME, highlighting the increased institutional interest in the industry.

- The derivatives market now represents 72.7% of the entire crypto market (vs 69.0% in February). This is an all-time high for the market share of derivatives.

Binance’s Spot Market Share Slides After Halting Trading Incentives

Binance’s spot market share across top-tier exchanges fell for the first time in five months, decreasing from 62.0% in February to 57.7% in March. The decline in its market share coincides with the recent legal issues faced by BinanceUSD, and the halting of trading incentives such as zero-fee trading pairs for BTC-BUSD, and ETH-BUSD pairs.

Spot trading volume on Binance rose 2.54% to $554bn, while its counterparts saw a significant increase with OKX and Coinbase registering a rise of 29.7% and 23.5% to $54.9bn and $49.3bn, respectively. Currently, Binance offers only zero-fee trading for BTC-TUSD and ETH-TUSD trading pairs. Meanwhile, Binance’s derivatives market share has continued to rise, recording an all-time high market share of 64.0% as of March.

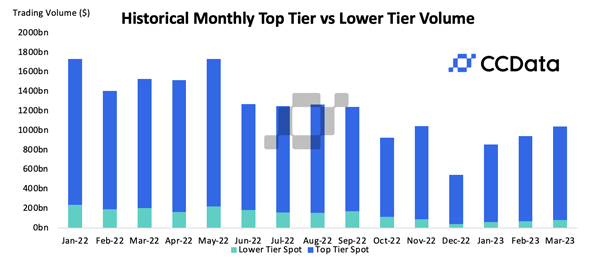

Trading Volumes Rise for Third Consecutive Month

In March, the total spot trading volumes rose 10.8% to $1.04tn, recording the third consecutive increase in monthly volumes. Top-Tier spot volumes increased 10.2% to $959bn, and Lower-Tier spot volumes increased 19.1% to $82.1bn. This is the highest spot trading volume recorded on centralised exchanges since September 2022.

Derivatives volumes increased by 32.6% in March to $2.77tn. The derivatives market now represents 72.7% of the entire crypto market (vs 69.0% in February). This is an all-time high for the market share of derivatives.

Derivatives Market Share Reaches All-time High

In March, the derivatives trading volume across centralised exchanges rose 32.6% to $2.77tn, the highest volume since September 2022. Meanwhile, the spot trading volume on centralised exchanges rose 10.8% to $1.04tn. The market dominance of derivatives trading on centralised exchanges has now risen to 72.7% from 69.0% in February, registering an all-time high for its market share.

Daily CME Volumes Hits the Highest Levels Since FTX Collapse

In March, CME’s BTC Futures volume rose 40.5% to $35.1bn, while CME’s BTC Micro Futures traded $697mn in monthly volume, up 46.2% from the month prior. This is the highest BTC futures volume traded in CME since May 2022.

276,542 BTC futures contracts were traded in March, up 30.2% since February. This only includes CME’s Bitcoin Futures, where the underlying asset is 5 Bitcoin. It excludes Bitcoin Micro Futures, where the underlying asset is 1/10th of a Bitcoin.