CCData's Stablecoins & CBDCs Report offers insight into the latest developments in the stablecoin and CBDC sector, focusing on analysis that relates to market capitalisation, trading volume, peg deviation and more.

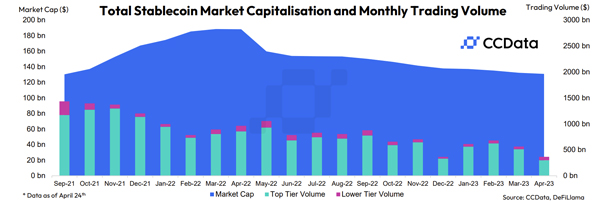

In April, the total market capitalisation of stablecoins fell 1.08% to $131bn (up to 24th April), the lowest stablecoins market cap since September 2021 and the thirteenth consecutive month of decline.

Despite the overall decline, stablecoin market dominance witnessed a slight increase from 10.8% in March to 10.9% in April, albeit still below its all-time high of 16.6% recorded in December 2022. This subtle rise in dominance is indicative of profit-taking and falling crypto asset prices, with both Bitcoin and Ethereum recently struggling to surpass key resistance levels.

You can access the report here.

- Stablecoin trading volume grew by 13.6% to $775bn in March, driven by multiple stablecoins depegging during the month. However, April's trading volume appears to be on track for a lower monthly figure, with only $365bn traded as of April 24th.

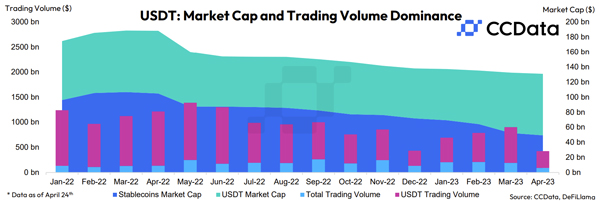

- The market capitalisation of USDT rose 2.03% to $81.5bn in April, with the stablecoin nearing its all-time high market cap of $83.7bn (recorded on May 1, 2022).

- USDT stablecoin trading volume represented 79.0% of all trading volume with stablecoins on centralised exchanges in April. With 2,931 trading pairs, USDT also represents the largest counterparty on centralised exchanges.

- In March, trading volumes with USDC on centralised exchanges rose 186% to $48bn, recording the highest volumes since September 2022, likely due to the assets depeg in March. The trading volumes remain relatively high in April, trading $20.2bn as of the 24th of April.

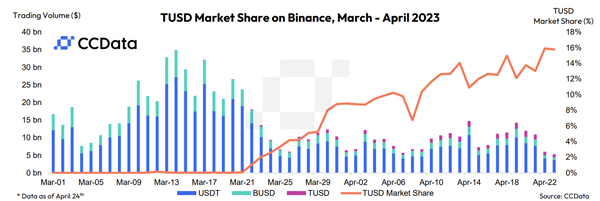

- With the launch of zero-fee spot trading for BTC and ETH trading pairs of TUSD on Binance, the market share of the stablecoin trading volume on the exchange has risen to an all-time high of 15.9%, trading $987mn on 22nd April. TUSD is now the third largest stablecoin by trading volume with a market share of 6.5% (on centralised exchanges), surpassing USDC for the first time since June 2020.

USDT Trading Volume Accounted for 79.0% of All Stablecoin Volume in April

The market capitalisation of USDT rose 2.03% to $81.5bn in April, with the stablecoin nearing its all-time high market cap of $83.7bn (recorded on May 1, 2022). The stablecoin’s market dominance has now risen for the fifth consecutive month to 62.1% - USDT’s highest dominance since April 2021.

USDT also represented 79.0% of all trading volume with stablecoins on centralised exchanges in April. With 2,931 trading pairs, USDT represents the largest counterparty on centralised exchanges followed by USD with 2,246 trading pairs.

Total Stablecoin Market Capitalisation Declines for 13th Consecutive Month

In April, the total market capitalisation of stablecoins fell 1.08% to $131bn, the lowest stablecoins market cap since September 2021. This is the thirteenth consecutive month of decline in stablecoins market capitalisation.

Stablecoin trading volume grew by 13.6% to $775bn in March, driven by multiple stablecoins depegging during the month. However, April's trading volume appears to be on track for a lower monthly figure, with only $365bn traded as of April 24th.

TUSD Market Share on Binance Rises to All-time High as 0 Fee Trading Starts

With the launch of zero-fee spot trading for BTC and ETH trading pairs of TUSD on Binance, the market share of the stablecoin trading volume on the exchange has risen to an all-time high of 15.9%, trading $987mn on 22nd April.

TUSD is now the third largest stablecoin by trading volume with a market share of 6.5% (on centralised exchanges), surpassing USDC for the first time since June 2020.

The information provided by this report does not constitute any form of advice or recommendation by CCData. Any redistribution of charts appearing in this Review must cite CCData as the sole provider and creator.