Stablecoins have grown to become a prominent subsector of the digital asset industry, growing significantly in size and interest over the last few years. In this report, we provide insight into the latest stablecoin and CBDC developments, analysing market capitalisation, trading volumes, stablecoin trends, peg deviations, and more.

The total market capitalisation of stablecoins rose 0.9% to $129bn (as of Dec 18th), continuing the asset class’s resurgence after adding $4.25bn to their supply in November. This is the highest market capitalisation for stablecoins since May. Stablecoin volumes also continue to trend upwards, with November seeing the highest stablecoin volumes since March. As of the 18th, volumes are on track to record a higher total in December.

Key Findings:

- In November, the total market capitalisation of stablecoins rose 3.43% to $128bn, recording the largest monthly supply increase since February 2022. The market cap is on trend to rise further in December, with the asset class recording a 0.17% increase to $129bn as of the 18th. Meanwhile, stablecoin market cap dominance fell to 8.07% in December, its lowest share since December 2021.

- In December, the market capitalisation of USDT rose 1.64% to $90.8bn, an all-time high for the stablecoin and recording the first instance of a stablecoin crossing $90bn in market cap. Trading volume for USDT pairs on centralised exchanges also reached $662bn in November, the highest level recorded since March 2023.

- In December, FDUSD's market capitalisation rose 92.6% to $1.63bn (as of Dec 18th), recording a new all-time high for the stablecoin. This was also the first time FDUSD achieved the title of fifth largest stablecoin, surpassing BinanceUSD (BUSD), which used to account for nearly 36.4% of Binance's trading volumes. This shift follows BUSD's gradual phase-out in favour of TrueUSD and First Digital USD.

- In December, leading stablecoin issuer Tether announced that they have onboarded the DOJ, FBI and the U.S. Secret Service to prevent the illegal use of USDT. The announcement followed Tether’s freezing of 326 wallets with amounts totalling $435mn on the instruction of US authorities on December 17th. As per on-chain data, Tether has banned a total of 1,237 wallets since it launched, with December accounting for the largest MoM increase on record.

Stablecoins Add the Largest Monthly Supply Since Feb 2022

In November, the total market capitalisation of stablecoins rose 3.43% to $128bn, recording the largest monthly supply increase since February 2022. The market cap is on trend to rise further in December, with the asset class recording a 0.17% increase to $129bn as of the 18th. Meanwhile, stablecoin market cap dominance fell to 8.07% in December, recording the lowest market share since December 2021.

In terms of volume, Stablecoin trading rose 56.2% to $782bn in November, recording the highest stablecoins trading volume on CEXs since March. Volumes are on track to record a higher total in December, with $557bn traded in volume on CEXs as of the 18th.

.jpg)

USDT Reaches All-time High Market Cap, Surpassing $90bn

In December, the market capitalisation of USDT rose 1.64% to $90.8bn, an all-time high for the stablecoin and recording the first instance of a stablecoin crossing $90bn in market cap. Trading volume for USDT pairs on centralised exchanges also reached $662bn in November, the highest level recorded since March 2023.

The rise in USDT supply, coinciding with the resurgence of USDT market capitalisation hints at the inflow of new capital to the markets amidst the bullish price action of crypto assets in the recent months. In November, the trading volume of USDT rose to $662bn, the highest since March 2023.

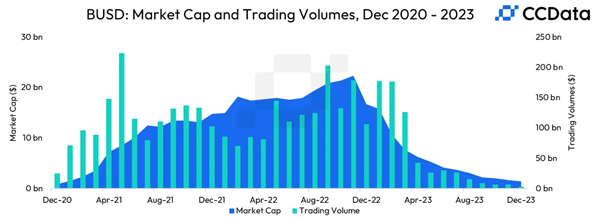

Binance Announces End of Support for BUSD on December 15th

On November 29th, Binance announced that it would be ending its support for popular stablecoin, BinanceUSD (BUSD). December 15th will mark the end of the stablecoin that first started trading on the exchange in September 2019. During its peak, BUSD pairs accounted for 36.4% of the trading on the exchange.

Since the SEC lawsuit against Paxos in February earlier this year, Binance started gradually replacing BinanceUSD (BUSD) with TrueUSD (TUSD), and more recently, First Digital USD (FDUSD). The latter saw its market cap surpass $1bn in December, currently accounting for nearly 20% of the volumes on Binance with a monthly volume of $50.8bn.

CCData is an FCA-authorised benchmark administrator and global leader in digital asset data, providing institutional-grade digital asset data and settlement indices. By aggregating and analysing tick data from globally recognised exchanges and seamlessly integrating multiple datasets, CCData provides a comprehensive and granular overview of the market across trade, derivatives, order book, historical, social and blockchain data.

The information provided by this report does not constitute any form of advice or recommendation by CCData. Any redistribution of charts appearing in this Review must cite CCData as the sole provider and creator.

.jpg)