The digital asset market has undergone significant shifts during the first half of 2023. In this report, CCData explores how regulatory scrutiny has impacted liquidity across markets, particularly in the U.S., and how this has been driven by key events such as the recent accusations made by the SEC.

Additionally, CCData delves into the consequences of the largest BTC long position liquidations since the FTX collapse and the increasing dominance of the derivatives market amidst declining spot trading volumes.

Download the full report here.

Key takeaways:

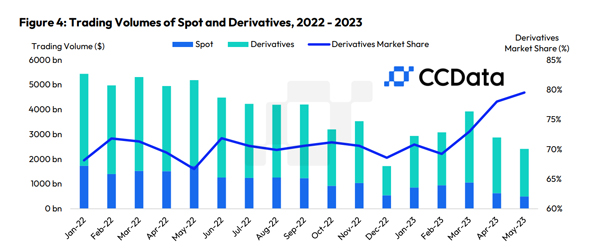

- Derivatives market share continued to rise for the third consecutive month to 79.8%, hinting at the speculative nature of the market at present. Meanwhile, spot trading volume fell 21.8% to $495bn in May, recording the lowest monthly trading volume since March 2019, highlighting the lack of liquidity and accumulation of crypto assets under the current uncertain macroeconomic conditions.

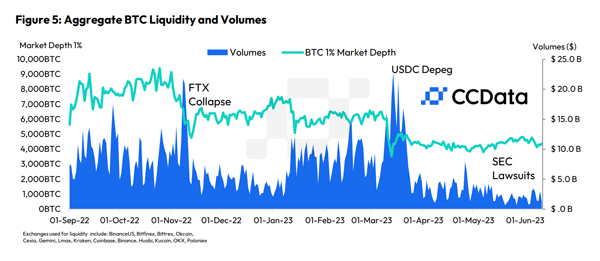

- Currently, the aggregate liquidity for Bitcoin (BTC) stands at approximately 3,400 BTC (for 14 analysed exchanges), a 53.4% decrease from its peak prior to the FTX collapse on October 25th and a 40.8% decrease compared to the beginning of 2023.

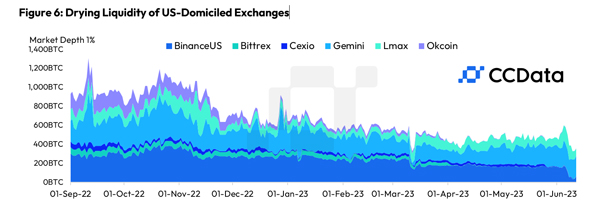

- 1% market depth on U.S. exchanges has notably dropped from 1,500 BTC to 400 BTC, possibly due to regulatory and macroeconomic pressures. The impact differs among exchanges: OkCoin, Bittrex, Cexio, and BinanceUS have faced significant liquidity declines of 97.6%, 99.2%, 70.6%, and 78.4% YTD, respectively, with Bittrex and Binance.US facing SEC actions.

- As explored in Figure 4, there has been a large decline in spot volumes relative to futures. As such, we have seen declining volumes and liquidity but increased open interest for BTC. YTD aggregate open interest has increased from around $6bn to around $7.8bn. Additionally, the BTC price has increased from $16,500 to $25,900.

Yearly Evolution of Spot vs Derivatives Trading Volumes

Derivatives market share continued to rise for the third consecutive month in May to 79.8%, hinting at the speculative nature of the market at present. Meanwhile, spot trading volume fell 21.8% to $495bn in May, recording the lowest monthly trading volume since March 2019 and highlighting the lack of liquidity under the current uncertain macroeconomic conditions.

Overview of BTC Liquidity and Trading Volumes

Increased regulatory scrutiny has significantly impacted liquidity across various markets, including the digital asset market. Currently, the aggregate liquidity for Bitcoin (BTC) stands at approximately 3,400 BTC (for 14 analysed exchanges), a 53.4% decrease from its peak prior to the FTX collapse on October 25th and a 40.8% decrease compared to the beginning of 2023.

The impact of these regulatory actions has been particularly pronounced in the United States, where market makers have exited the space, resulting in a greater impact on liquidity.

Shrinking Liquidity Trends in U.S. Crypto Exchanges

Since November, 1% market depth on U.S. exchanges has notably dropped from 1,500 BTC to 400 BTC, possibly due to regulatory and macroeconomic pressures.

The impact differs among exchanges: OkCoin, Bittrex, Cexio, and BinanceUS have faced significant liquidity declines of 97.6%, 99.2%, 70.6%, and 78.4% YTD, respectively, with Bittrex and Binance.US encountering SEC actions.

LMAX, Gemini, and Coinbase saw declines of 5.01%, 34.3%, and 36.7% YTD, respectively.

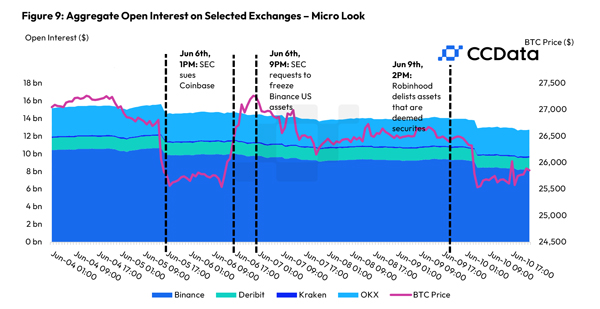

Open Interest Plummets as Markets Record the Largest Liquidation Event Since FTX

Open Interest as well has been one of the major metrics affected by the current turmoil. The SEC's statement on June 5th set off a major wave of BTC-long liquidations at a scale which hasn’t been seen since the collapse of FTX.

As a result, aggregate open interest in the markets fell by 4.51% within an hour, highlighting the scale of leverage in the markets. The announcement caught bullish traders by surprise, particularly affecting altcoins, such as Cardano and Solana, which were specifically mentioned in the lawsuit and are now considered securities by the SEC. These tokens experienced the most substantial declines.