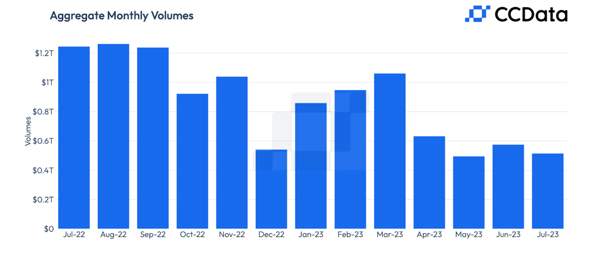

In July, the combined spot and derivatives trading volume on centralised exchanges fell 12.0% to $2.36tn, the lowest monthly trading volume recorded this year. The decrease in trading volumes can be attributed to the lack of volatility in the price action of major crypto assets, with Bitcoin and Ethereum trading in a narrow range throughout July.

Spot trading volumes on centralised exchanges fell by 10.5% to $515bn, the second lowest volumes recorded since March 2019. Meanwhile, derivatives volumes fell by 12.7% to $1.85tn, the second-lowest volume recorded since December 2020.

Download the full report here.

Key takeaways:

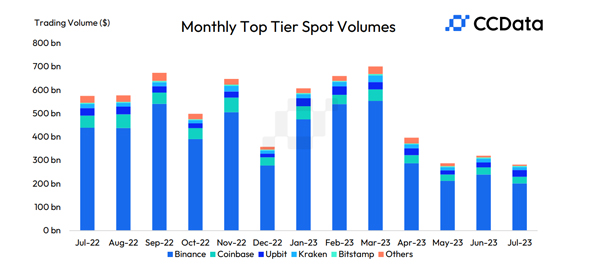

- Binance remains the largest venue for spot trading in crypto, recording $208bn in volumes. However, the exchange’s market share has declined for the fifth consecutive month, falling to 40.4% in July, its lowest market share since August 2022.

- Spot trading volume on Upbit rose 42.3% to $29.8bn in July, outperforming the general market trend. This is the first time Upbit has outtraded the likes of OKX and Coinbase, which saw their volumes fall 11.6% and 5.75% to $28.6bn and $29.0bn, respectively. Upbit is now the second-largest exchange by trading volume after Binance.

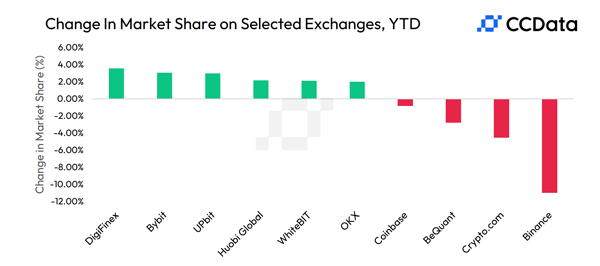

- Upbit sees the largest increase in YTD market share while Binance faces an 11% decline. Compared to last month, Upbit saw the largest increase in market share, with the exchange now accounting for 5.78% of the trading volumes on centralised exchanges. Huobi Global and Kucoin also increased their market share by trading volume, rising 1.92% and 0.47% to 3.84% and 2.21% respectively.

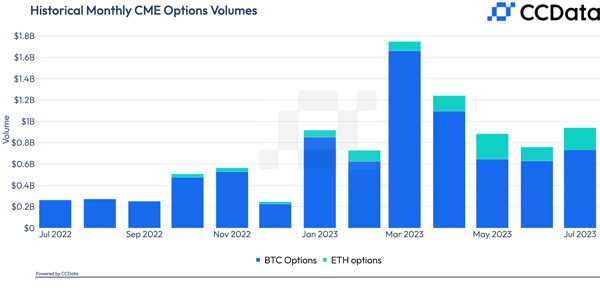

- In July, the total derivatives trading volume on the CME fell 17.0% to $40.1bn. In line with the general trend in the derivatives market, the futures volume on the exchange fell 17.6% to $39.1bn, with BTC and ETH futures volume falling to $31.3bn and $7.24bn, respectively.

- Options trading volume on the CME rose 24.0% to $940mn, recording the first increase in four months. The BTC options traded on the exchange rose 16.6% to $734mn, while ETH options saw trading volumes rise 60.0% to $207mn.

Centralised Exchanges Record the Second Lowest Volume Since 2021

Trading volumes on centralised exchanges, which have been at record lows the past few months, continued to decline in July, with the combined spot and derivatives trading volume falling 12.0% to $2.36tn. This was the second-lowest combined volume on centralised exchanges since December 2020, eclipsed only by December 2022.

Spot trading volumes on centralised exchanges fell by 10.5% to $515bn, the second lowest volumes recorded since March 2019. Meanwhile, derivative volumes fell by 12.7% to $1.85tn, recording the second-lowest volume since December 2020. As a result, the derivatives market share fell for the second consecutive month to 78.2%

Upbit Overtakes OKX and Coinbase Volumes For the First Time

In July, spot trading volume on Upbit rose 42.3% to $29.8bn, outperforming the general market trend. This is the first time Upbit has outtraded the likes of OKX and Coinbase, which saw their volumes fall 11.6% and 5.75% to $28.6bn and $29.0bn, respectively.

Upbit is now the second-largest exchange by trading volume after Binance, which recorded $208bn in volumes. However, the exchange’s market share declined for the fifth consecutive month, falling to 40.4% in July, its lowest market share since August 2022.

Upbit Sees Largest Increase in YTD Market Share While Binance Faces 11% Decline

Compared to last month, Upbit saw the largest increase in market share, with the exchange now accounting for 5.78% of the trading volumes on centralised exchanges. Huobi Global and Kucoin also increased its market share by trading volume, rising 1.92% and 0.47% to 3.84% and 2.21% respectively.

Year-to-date, DigiFinex, Bybit, and Upbit have all gained market share, increasing their dominance by 3.56%, 3.06%, and 2.98% to 4.74%, 3.98%, and 5.78%. Meanwhile, Binance, Crypto.com and BeQuant saw the largest decline in market share by trading volume, falling 11.0%, 4.54%, and 2.77% to 40.4%, 0.46%, and 0.96%, respectively.

CME BTC Options Volume Rises for the First Time in Four Months

In July, the total derivatives trading volume on the CME fell 17.0% to $40.1bn. In line with the general trend in the derivatives market, the futures volume on the exchange fell 17.6% to $39.1bn, with BTC and ETH futures volume falling to $31.3bn and $7.24bn, respectively.

However, options trading volume on the exchange rose 24.0% to $940mn, recording the first increase in four months. The BTC options traded on the exchange rose 16.6% to $734mn, while ETH options saw trading volumes rise 60.0% to $207mn.

The information provided by this report does not constitute any form of advice or recommendation by CCData. Any redistribution of charts appearing in this Review must cite CCData as the sole provider and creator.

About CCData

CCData is an FCA-authorised benchmark administrator and global leader in digital asset data, providing institutional-grade digital asset data and settlement indices. By aggregating and analysing tick data from globally recognised exchanges and seamlessly integrating multiple datasets, CCData provides a comprehensive and granular overview of the market across trade, derivatives, order book, historical, social and blockchain data.