CCData is pleased to present its latest report, Institutional Primer: The Impact Of The First US Spot Bitcoin ETFs, which explores the developments following the U.S. Securities and Exchange Commission's (SEC) decision to approve a spot Bitcoin Exchange-Traded Fund (ETF). This report not only provides a comprehensive overview of the immediate market reactions but also offers a deep dive into the broader implications of this milestone.

You can access the report here, as well as additional insights and charts below.

Key findings

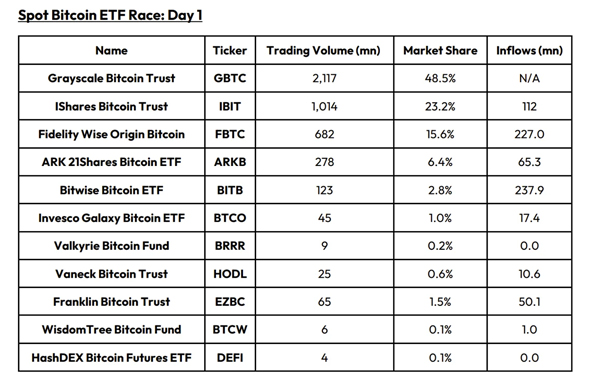

- The 11 spot Bitcoin ETFs traded an aggregate volume of $4.37bn on the first day since their launch. Grayscale Bitcoin Trust (GBTC) accounted for nearly 50% of trading volumes, with most expected to be outflows to the new ETFs that are now available. BlackRock’s iShares Trust and Fidelity’s Wise Origin Bitcoin Fund were the largest beneficiaries, accounting for 23.2% and 15.6% of the volumes.

- Based on the latest provisional data at the time of writing, Bitwise had the largest inflows among the spot Bitcoin ETFs, netting around $230mn in inflows, followed by Fidelity with an inflow of $227mn. Blackrock’s latest provisional data shows that it had an inflow of $111mn, however, this figure is expected to be updated considering the volumes traded on the first day.

-

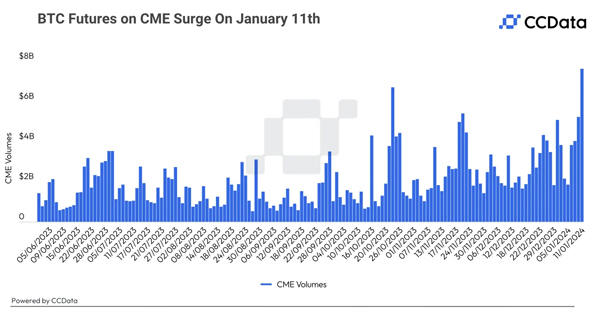

Speculation on the impact of spot Bitcoin ETF continues to ramp on institutional venues with ProShares BITO recording nearly $2bn in volumes, the highest ever for the futures ETF. The CME exchange also saw a spike in the BTC futures volume traded, recording $7.33bn in volumes.

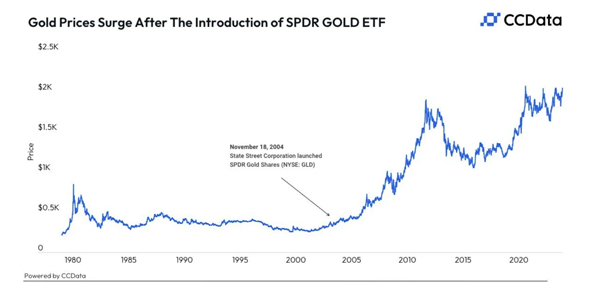

- Historical data from the launch of the first gold ETF in the US in November 2004 provides insights into a potential Bitcoin ETF's impact. Gold's price steadily increased from $375 in May to $442 on the ETF launch day, reaching $454 shortly after due to substantial inflows. However, it later retraced to $411 by early February 2005. This historical precedent suggests that, upon approval of a Bitcoin ETF, we may observe a similar pattern: an initial price surge driven by anticipation, followed by a brief breakout, and subsequently a correction in the Bitcoin market.

- The second largest crypto asset by market capitalisation, Ethereum, has outperformed since the ETF approval announcement, with the ETH/BTC ratio looking set to reverse the downtrend of the past few months. The reaction from the markets since the announcement of ETF approval suggests that conversations have already opened about the possibility of an Ethereum ETF, with seven applicants already in the race for approval.

The Run-Up to The First Spot Bitcoin ETF

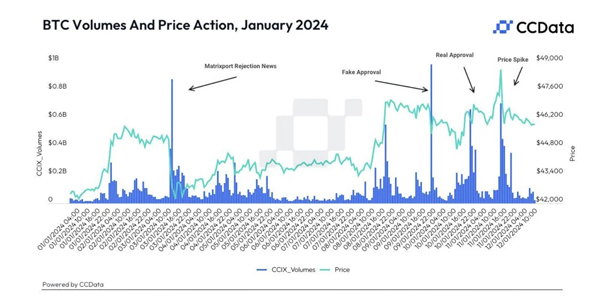

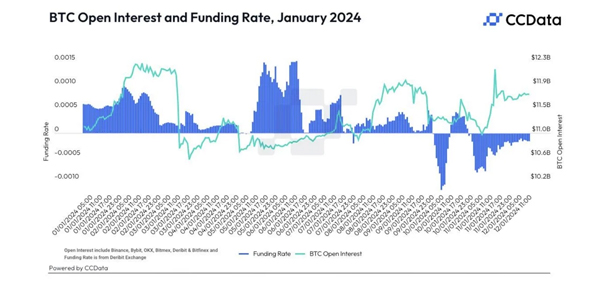

As the approval date for the Bitcoin ETF neared, its price and trading volume exhibited a stochastic pattern. Initial rumors from Matrixport of a delayed approval triggered a bearish trend, with both price and open interest dropping significantly. This pushed Bitcoin's price down to the $42,000 level.

However, this bearish sentiment shifted dramatically on the 9th after a false announcement of approval. Trading volumes surged, as evidenced by CCData's CCIX index for BTC-USDT, reaching peak hourly volumes of $984mn. This volatile trend continued on the 10th, the true approval date. While volumes remained high at $664mn in the first hour of trading, they failed to match the previous day's spike.

Despite lacking the same volume spike, market sentiment turned bullish on the 11th, the first day of ETF trading. Bitcoin's price rose moderately, reaching a new resistance level of around $48,600, before settling back at approximately $45,900. An increase in open interest combined with positive funding rates further supported this shift towards a more positive market sentiment.

Breaking Down The First Day of ETF Trading

The 11 spot Bitcoin ETFs traded an aggregate volume of $4.37bn on the first day since their launch. Grayscale Bitcoin Trust (GBTC) accounted for nearly 50% of the trading volumes, with most expected to be outflows to the new ETFs that are now available to investors. BlackRock’s IShares Trust and Fidelity’s Wise Origin Bitcoin Fund were the largest beneficiaries, accounting for 23.2% and 15.6% of the volumes.

Based on the latest provisional data at the time of writing, Bitwise had the largest inflows among the spot Bitcoin ETFs, netting around $230mn in inflows, followed by Fidelity with an inflow of $227mn. Blackrock’s latest provisional data shows that it had an inflow of $111mn, however, this figure is expected to be updated considering the volumes traded on the first day.

Meanwhile, speculation on the impact of spot Bitcoin ETF continues to ramp on institutional venues with ProShares BITO recording nearly $2bn in volumes, the highest ever for the futures ETF. The CME exchange also saw a spike in the BTC futures volume traded, recording $7.33bn in volumes.

Looking Forward

Historical data from the launch of the first gold ETF in the US in November 2004 provides insights into a potential Bitcoin ETF's impact. Gold's price steadily increased from $375 in May to $442 on the ETF launch day, reaching $454 shortly after due to substantial inflows. However, it later retraced to $411 by early February 2005. This historical precedent suggests that, upon approval of a Bitcoin ETF, we may observe a similar pattern: an initial price surge driven by anticipation, followed by a brief breakout, and subsequently a healthy correction in the Bitcoin market.

By August 2011, as gold prices hit a record high, SPDR Gold Shares (GLD) briefly became the world’s largest ETF, surpassing the SPDR S&P 500 Trust ETF in value. With Bitcoin vying for a similar position as Gold for the alternative asset class as the store of value, one can only wonder about the long-term growth potential for the Bitcoin asset class.

CCData is an FCA-authorised benchmark administrator and global leader in digital asset data, providing institutional-grade digital asset data and settlement indices. By aggregating and analysing tick data from globally recognised exchanges and seamlessly integrating multiple datasets, CCData provides a comprehensive and granular overview of the market across trade, derivatives, order book, historical, social and blockchain data.