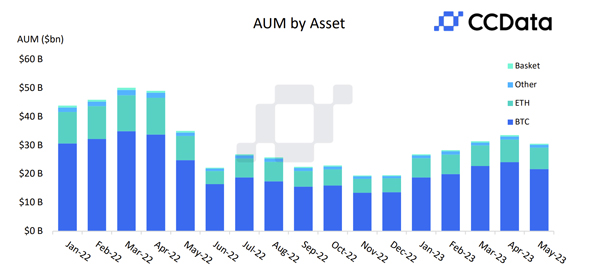

For the first time in 2023, the digital asset sector witnessed a decrease in the total assets under management (AUM) for digital asset investment products, with overall AUM shrinking by 8.92% to $30.6bn in May. Despite this dip, the year-to-date growth of AUM stands at 55.5%.

Bitcoin and Ethereum-based products saw their first drop in 2023 recording a decline of 10.3% and 4.42%, respectively, reaching $21.7bn and $7.50bn. “Other” and “Basket” followed the same trend, recording a decline of 12.04% to $958mn and 8.09% to $434mn, respectively.

Download the full report here.

Key takeaways:

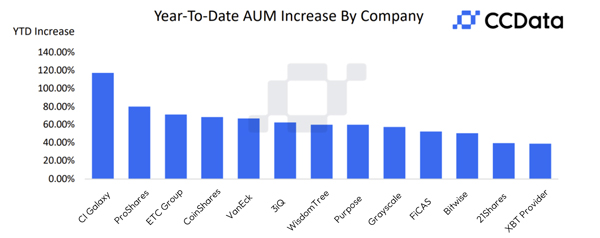

- CI Galaxy emerged as the frontrunner so far this year, experiencing a remarkable 118% increase in AUM. Followed closely by ProShares, with an 80.1% increase, and ETC Group with a 71.5% increase in AUM.

- May saw the first 2023 drop in AUM for Bitcoin and Ethereum products, down by 10.3% and 4.42% respectively. This shift reduced Bitcoin's market share from 72.0% to 70.9% but increased Ethereum's from 23.4% to 24.5%.

- VanEck recorded the highest increase in AUM in May, rising 2.25% to $334mn, followed by CI Galaxy which recorded a decrease of 3.45% to $523mn. Grayscale retained its position as the dominant player with products recording a total AUM of $23.0bn.

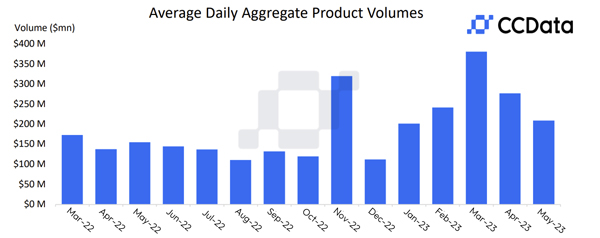

- Average daily aggregate volumes of digital asset investment products experienced a decline for the third consecutive month in May, resulting in a significant decrease of 24.6% to $209 million. This decline followed a period of relative stability in the market, characterised by digital assets like Bitcoin trading within a narrow range.

Digital Asset Management Companies See Major YTD Increase in AUM

Despite experiencing their first setback of 2023, digital asset management firms have showcased robust performance this year, with a rise in year-to-date (YTD) assets under management (AUM).

CI Galaxy has set the pace this year, witnessing an impressive 118% surge in AUM. ProShares and ETC Group follow, with AUM increasing by 80.1% and 71.5%, respectively.

Average Daily Aggregate Volumes Experience Third Consecutive Monthly Decline

In May, the digital asset investment products sector saw a continued downturn for the third month in a row, with the average daily aggregate volumes declining by 24.6% to $209mn.

Following a spell of relative market stability, where digital assets such as Bitcoin traded within a confined range, this decline led the industry to its second-lowest volume for 2023. Only the volume registered in January fell below this level.

Ethereum-based Products Gain Market Share as Bitcoin-based Products Decline

The first decline in 2023 for Bitcoin and Ethereum-based product assets under management (AUM) was recorded in May, with respective drops of 10.3% and 4.42%, reducing their totals to $21.7bn and $7.50bn. This decline has impacted market shares: Bitcoin's share slipped from 72.0% in April to 70.9% in May, while Ethereum's rose from 23.4% to 24.5% over the same period.