June was marked by several significant developments across the digital asset investment product sector. Most notably, BlackRock filed its first spot Bitcoin ETF application, sparking a wave of optimism in the markets, with Bitcoin reaching the $31,400 level for the first time since June 2022. Historically, BlackRock has submitted over 500 ETF applications, with only 1 rejection.

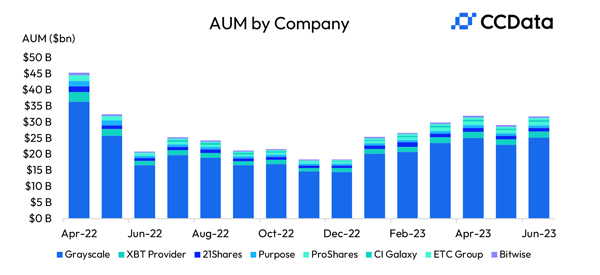

Additionally, the launch of EDX Market by Fidelity, Charles Schwab, and Citadel further enhanced market optimism. Total AUM for digital asset products saw a 9.05% increase, reaching $33.4bn. Average daily aggregate volumes of digital asset investment products also rebounded, increasing by 6.77%.

Download the full report here.

Key takeaways:

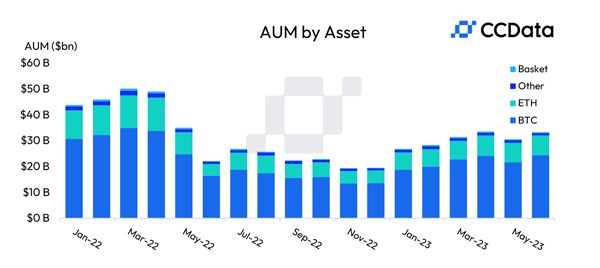

- Total assets under management (AUM) for digital asset investment products experienced an increase of 9.05% compared to May and 69.5% year-to-date, reaching $33.4bn in June. Bitcoin-based products experienced a notable surge, with assets under management (AUM) increasing by 12.4% to $24.4 billion

- In June, the average daily aggregate volumes of digital asset investment products rebounded with a 6.77% increase, following two consecutive months of decline, reaching a total of $223 million. This increase was aligned with the overall market trend, as the entire market experienced a significant uptick in volumes.

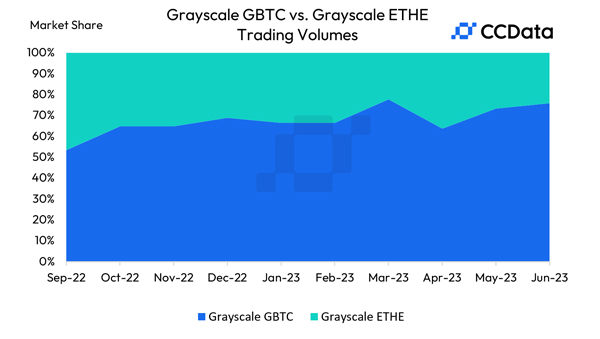

- Grayscale's Bitcoin Trust product, GBTC, saw its volumes increase by 78.9% to $45.0 million in June, capitalising on the BlackRock news and maintaining its position as the most traded Trust product in the industry

- Following BlackRock's ETF application, the discount for Grayscale’s GBTC and ETHE has decreased. On the 23rd of June, BTCG had a discount of 31.0%; a level which hasn't been seen since September 2022. Similarly, but less significantly, Ethereum recorded a discount of 46.7%.

Bitcoin-Based Products Dominate with 12.4% AUM Increase and 73.1% Market Share

In June, the market for Bitcoin-based products experienced a notable surge, with assets under management (AUM) increasing by 12.4% to $24.4 billion. This growth resulted in Bitcoin-based products capturing a market share of 73.1%, a 3.0% increase from 70.1% in May. On the other hand, Ethereum-based products saw a comparatively smaller increase of 2.68%, leading to a market share of 23.1% (down from 24.5% in May).

GBTC's Trading Volume Rises to $45M Amid Growing Sentiment for Bitcoin

Starting from September 2022, GBTC's trading volume rose from $35.6 million to $45.0 million in June 2023, capturing 74.0% of the total trading volume for trust products, compared to 50.9% in September. In contrast, ETHE's volumes declined from $31.0 million in September to $14.4 million in June 2023, and from 44.4% to 23.6% market share among all trust products.

The surge in GBTC's volumes and market share aligns with the growing positive sentiment towards the underlying asset and the restoration of the haven narrative for Bitcoin and Bitcoin-based products.

3iQ CoinShares Records 91% AUM Increase in June

In June, 3iQ CoinShares recorded the highest increase in AUM, rising 91.0% to $150 million, followed by ProShares which recorded an increase of 12.3% to $1.12 billion. Grayscale retained its position as the dominant player with products recording a total AUM of $25.3 billion.

The information provided by this report does not constitute any form of advice or recommendation by CCData. Any redistribution of charts appearing in this Review must cite CCData as the sole provider and creator.

About CCData

CCData is an FCA-authorised benchmark administrator and global leader in digital asset data, providing institutional-grade digital asset data and settlement indices. By aggregating and analysing tick data from globally recognised exchanges and seamlessly integrating multiple datasets, CCData provides a comprehensive and granular overview of the market across trade, derivatives, order book, historical, social and blockchain data.