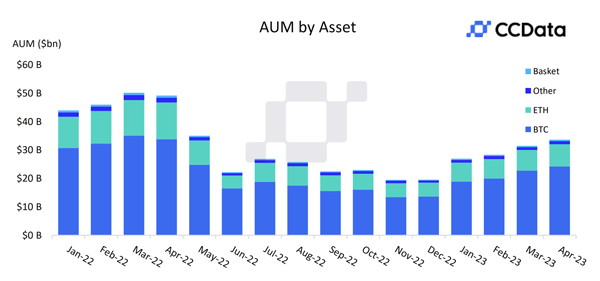

In April, the total assets under management (AUM) for digital asset investment products rose by 6.94% to reach $35.6 billion, marking the fifth consecutive month of growth in AUM for digital asset products. The year-to-date increase in AUM now stands at 59.9%, highlighting the renewed interest in digital assets amid failures within traditional finance and market turbulence.

Bitcoin and Ethereum-based products saw an increase of 6.34% and 8.72%, respectively, reaching $24.2 billion and $7.85 billion AUM, with the latter following the successful implementation of the Shapella Upgrade.

Download the full report here.

Key takeaways:

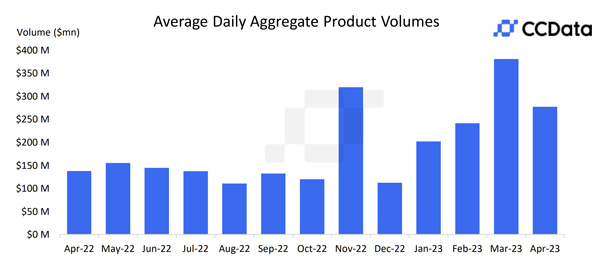

- The average daily aggregate product volumes across all digital asset investment products fell 27.2% to $277mn in April. This is the first decline in average trading volumes since December, however, volumes remain at an elevated level in comparison to the average trading volumes recorded in 2022.

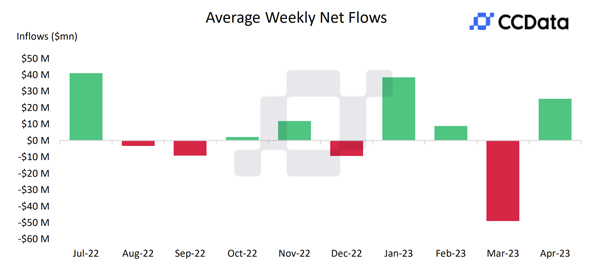

- In April, net flows reversed their trend, recording weekly average net flows of $25.4mn - the highest since January 2023. BTC-based products continued their dominance and recorded a positive net flow of $30.78mn following significant outflows in March.

- 3iQ recorded the highest increase in AUM in April, rising 21.9% to $430mn, followed by 21Shares and ETC Group with a 12.6% increase to $1.28 billion and 12.05% increase to $647mn, respectively.

- Grayscale retained its position as the dominant player with products recording a total AUM of $25.2 billion. This marks a 6.74% increase in AUM compared to March 2023, although it recorded a slight decline in market share, decreasing from 75.1% in March to 74.9% in April.

- Despite experiencing notable growth in assets under management (AUM) after the successful Shapella Upgrade, Ethereum-based products are still far from dominating the AUM of digital assets, which is mostly controlled by BTC-based products. BTC-based products have increased their market share from 69.9% in January 2023 to 72.0% in April, whereas ETH-based products have remained relatively stable, decreasing slightly from 24.8% to 23.4%.

Average Daily Aggregate Trading Volumes Reach Lowest Level Since December

In April, the average daily aggregate product volumes across all digital asset investment products fell 27.2% to $277mn. This is the first decline in average trading volumes since December, however, volumes remain at an elevated level in comparison to the average trading volumes recorded in 2022.

Bitcoin Dominance Continues Despite Boost in AUM for ETH-Based Products

Despite experiencing notable growth in AUM following the Shapella Upgrade, Ethereum-based products are still far from dominating the AUM of digital assets, which is mostly controlled by BTC-based products.

BTC-based products have increased their market share from 69.9% in January 2023 to 72.0% in April, whereas ETH-based products have remained relatively stable, decreasing only slightly from 24.8% to 23.4%. “Other” and “Basket” products have also remained low recording 3.24% and 1.40% in April.

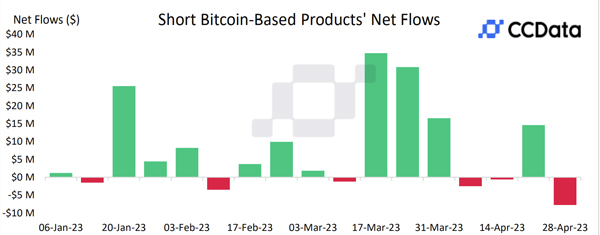

Short Bitcoin-Based Products Record Highest Weekly Outflows in 2023

In April, net flows reversed their trend, recording weekly average net flows of $25.4mn - the highest since January 2023. BTC-based products continued their dominance and recorded a positive net flow of $30.78mn following a significant outflow in March.

Short Bitcoin-based products, however, recorded their highest weekly outflows in 2023, which could be attributed to the upward momentum of BTC and the significant price increase that occurred during April 2023.

CCDAS Returns, Save 50% With Early Bird Tickets Today!

We are thrilled to announce that CCDAS, CCData's digital asset summit, is back and better than ever. Join us in central London on October 2nd for our curated VIP day and our flagship summit on October 3rd at Old Billingsgate!

As Europe’s leading institutional summit for digital assets, CCDAS brings key industry leaders and distinguished speakers together to discuss the sector's pressing challenges and opportunities.

|