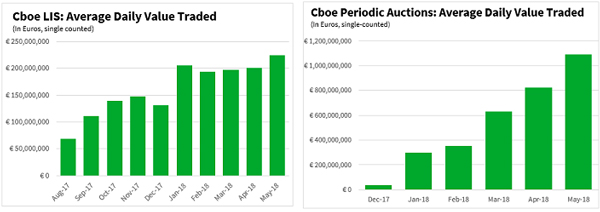

- Record average daily notional value (ADNV) traded of €224.7 million for Cboe LIS in May; Cboe Periodic Auctions book ADNV reaches €1.1 billion for the month

- Broker priority allocations on Cboe Periodic Auctions decrease to 21% in May, down from 30% in Q1

- 22.4% overall market share for Cboe Europe Equities in May, highest since October 2016

Cboe Global Markets, Inc. (Cboe: CBOE | Nasdaq: CBOE), one of the world’s largest exchange holding companies, today reported highlights from May 2018 for Cboe Europe Equities, including record average daily notional value (ADNV) traded for its block trading platform, Cboe LIS, as well as its Periodic Auctions book.

The proportion of activity on the Cboe Periodic Auctions book that is a result of broker priority allocations was 21% in May (also 21% in April) – compared to approximately 30% during the first quarter of the year – demonstrating the significant level of multi-lateral matching taking place in this order book.

Mark Hemsley, President of Europe for Cboe, said: “We continue to be pleased with the positive response and support we’ve received from our customers this year for Cboe LIS and Periodic Auctions. While volumes in our Periodic Auctions book have continued to grow, the proportion that is a result of non-broker priority allocations has risen to nearly 80%, which means a significant amount of addressable liquidity is available to market participants.

“Additionally, as the overall large-in-scale market has grown since the implementation of MiFID II, market participants are increasingly turning to Cboe LIS, which now accounts for 17% of the LIS market since launching just 18 months ago,” he added.

Cboe Europe Equities has seen good market share growth since MiFID II came into force at the beginning of 2018 with overall pan-European market share reaching 22.4% in May, its highest market share since October 2016.

Cboe Periodic Auctions – May Highlights

Cboe’s Periodic Auctions book is a MiFID II compliant, lit order book that allows market participants to trade with minimal market impact. It provides pre-trade transparency in accordance with MiFID II/RTS 1 by publishing indicative price and size prior to executing orders.

- In May, ADNV for Cboe’s Periodic Auctions reached €1.1 billion, up from €824.1 million in April

- Total notional value traded on Cboe Periodic Auctions in May was €25.0 billion

- Additional information about Cboe Periodic Auctions is available on the Cboe website:

Cboe LIS – May Highlights

Cboe LIS is an indication of interest and execution platform, powered by BIDS technology, that allows market participants to trade large blocks of European equities without leaking information to the market.

- Cboe LIS reported record ADNV traded of €224.7 million in May, up from €200.3 million in April

- Cboe LIS had its best day on record with €358.6 million traded on 30th May

- In May, average trade size for Cboe LIS was €1.2 million

- Total notional value traded on Cboe LIS in May was €5.2 billion

- Cboe LIS ADNV has increased 71% since December 2017