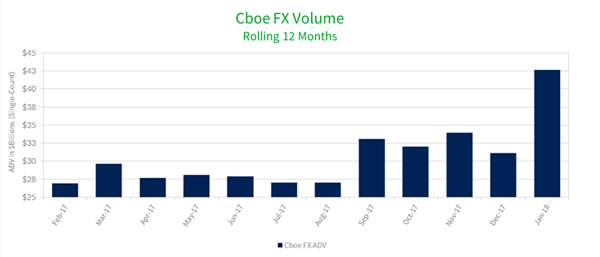

- January 2018 average daily volume (ADV) increases 44.2% year-on-year

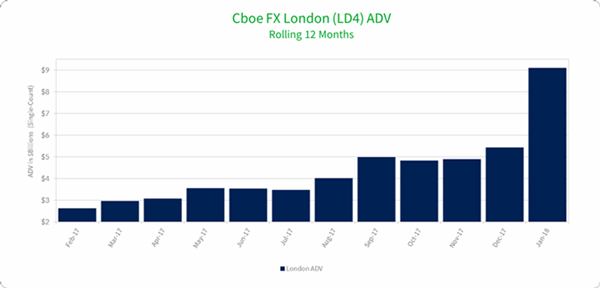

- Sets new one-day record of $68.4 billion traded on 25th January, of which a record $15.3 billion was transacted on the Cboe FX London matching engine

- Cboe FX London matching engine sets new month record with ADV of $9.1 billion, up 261% year-on- year

Cboe Global Markets, Inc. (Cboe: CBOE | Nasdaq: CBOE), one of the world’s largest exchange holding companies, today announced its foreign exchange (FX) market, Cboe FX, reported record spot average daily volume (ADV) of $42.6 billion in January, surpassing its previous record month of $38.2 billion set in September 2014. Year-on-year, Cboe FX ADV increased 44.2%.

Additionally, Cboe FX’s London matching engine reached record ADV of $9.1 billion in January, up 263% year- on-year, and accounted for 21.3% of Cboe FX’s overall volume in January, a new record. The Cboe FX London matching engine was launched in September 2015 to better serve the London and Asian markets and the specific FX currency pairs that dominate the European and Asian trading hours. In January, growth in Cboe FX’s Asian trading session has increased 62.6% year-on-year.

Bryan Harkins, Head of U.S. Equities and Global FX at Cboe, said: “We are pleased to start off 2018 with strong volume as we continue to extend our reach across Europe and Asia. Our London matching engine continues to gain traction and we really laid the foundation in 2017 investing in analytics and liquidity management tools and expertise. As a result, our customers are increasingly seeing the benefits as we help them improve their fill rates and experience on the Cboe FX platform.”

Cboe FX also continued to see increased success in trading of non-deliverable FX forwards (NDFs), which launched on the Cboe SEF late last year.