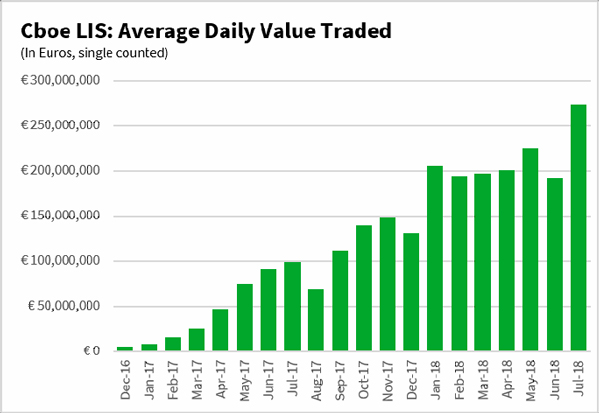

- Record average daily notional value (ADNV) traded of €273 million for Cboe LIS in July, up 21.3% over previous record month

- 158 buy-side firms globally now utilising the platform

Cboe Global Markets, Inc. (Cboe: CBOE | Nasdaq: CBOE), one of the world’s largest exchange holding companies, today reported that its European block trading platform, Cboe LIS, set a new monthly record in July with average daily notional value (ADNV) traded of €273 million, up 21.3% from its previous record month in May 2018.

When looking at large-in-scale (LIS) activity taking place on non-displayed venues, Cboe LIS accounted for 20% of that volume in July, according to data analytics provider big xyt.

Mark Hemsley, President of Cboe Europe, said: “When we launched Cboe LIS, we brought to the market a much- needed solution for trading large blocks of stock in the European market that was designed to meet the unique needs of the buy-side. The rapid adoption of Cboe LIS and our strong pipeline of new customers is a testament that our approach to block trading struck the right chord with the market and both our buy-side and sell-side customers are finding value utilising the platform.”

Cboe LIS is an indication of interest (IOI) and execution venue, powered by BIDS technology, that allows market participants to trade large blocks of European equities. Cboe LIS provides buy-side firms with control over their IOIs up until execution, which helps to protect against information leakage, while maintaining their important relationships with their brokers. Additionally, Cboe LIS is unique in that it brings together the block flow of both the buy-side and sell-side, which allows for greater crossing opportunities.

Cboe LIS – Additional July Highlights

- Total notional value traded on Cboe LIS in July was a record €6.0 billion notional

- Cboe LIS had its best day on record with €409 million notional traded on 18th July

- In July, average trade size for Cboe LIS was €1.0 million (€1.3 million for buy-side)

- Cboe LIS ADNV has increased 175% year-on-year

- 158 buy-side firms utilising the platform

Overall, Cboe Europe Equities has seen good market share growth since MiFID II came into effect at the beginning of 2018 with overall pan-European market share reaching 23.2% in July, its highest market share since October 2016.