- Record month for Cboe Periodic Auctions and Cboe LIS as MiFID II solutions see swift uptake with more than €11 billion traded on the two platforms in January

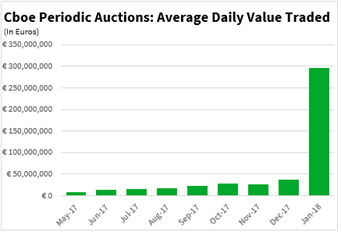

- Cboe Periodic Auctions book reports average daily notional value traded (ADNV) of €296 million in January, up 885.3% over Q4 2017 ADNV

- Cboe LIS reports record ADNV of €205 million in January, up 46.9% over Q4 2017 ADNV

- More than 70 buy-side firms now trade reporting through Cboe’s Approved Publication Arrangement (APA) now trade reporting through Cboe’s Approved Publication Arrangement (APA)

Cboe Global Markets, Inc. (Cboe: CBOE | Nasdaq: CBOE), one of the world’s largest exchange holding companies, today announced volume and highlights for Cboe Europe Equities for January 2018, summarising the first month of equities trading under MiFID II. January highlights include the following:

- Cboe Periodic Auctions sees significant uptake: The Cboe Periodic Auctions book reported a record month of volume trading more than €6.5 billion during January. Average daily notional value traded (ADNV) was

- €296 million, up 885.3% over the fourth quarter of 2017. Data from big xyt shows that trades on the Periodic Auctions book had less market impact than dark venues.

- Cboe Large in Scale (LIS) continues to grow: Cboe LIS, a European large-in-scale block trading platform powered by BIDS technology, reported another record month in January with more than €4.5 billion traded on the platform. Average daily notional value traded on Cboe LIS was €205 million, up 46.9% over the fourth quarter of 2017, and average trade size was €1,266,033.

- Increased volume on Cboe lit and dark books: Overall market volumes were up in January, which led to higher volumes on Cboe’s lit and dark books. Cboe’s lit books, excluding Periodic Auctions volume, were up 8.8% over the fourth quarter of 2017 to €8.4 billion ADNV. Cboe’s dark books were up 14.4% over the fourth quarter of 2017 to €1.2 billion ADNV.

- Increased number of buy-side firms trade reporting: More than 130 firms are utilising Cboe’s APA to report their trades under MiFID II, up from 30 firms in the fourth quarter of 2017. This figure includes more than 70 buy-side firms, many of which are utilising Cboe’s assisted reporting model to report their trades to the facility.

Mark Hemsley, President of Europe for Cboe, said: “It’s obviously still early days in MiFID II, but we are pleased with the swift uptake of our Periodic Auctions book and Cboe LIS, two solutions designed specifically for MiFID II. Overall market volumes were up in January, which had a positive impact across all of our markets. We believe we are well- positioned for the changing dynamics in the market, which we expect will accelerate when the double-volume caps come into effect later this quarter.”

|

|

January 2018 ADNV |

Q4 2017 ADNV |

Percent Change |

|

Cboe Displayed Venues (Lit Books) |

€8,379,864,143 |

€7,699,299,901 |

+8.8% |

|

Cboe Non-displayed Venues (Dark Books) |

€1,149,245,751 |

€1,004,387,777 |

+14.4% |

|

Cboe Periodic Auctions |

€296,256,927 |

€30,066,397 |

+885.3% |

|

Cboe LIS |

€205,557,766 |

€139,964,394 |

+46.9% |

|

Overall Total Consolidated Volume* |

€48,162,683,765 |

€43,697,524,031 |

+10.2% |

* Based on Cboe Europe Equities market coverage, available at markets.cboe.com.

Record Month for Cboe Periodic Auctions and Cboe LIS

Additional market volume information is available on the Cboe Europe Equities Market Volume Summary page.