Canadian defined benefit pension plans ended 2017 in positive territory, posting an annual return of 9.7 per cent, according to the $650 billion RBC Investor & Treasury Services All Plan Universe – the industry’s most comprehensive universe of Canadian pension plans – marking nine consecutive years of positive returns.

In addition, a recent RBC Investor & Treasury Services poll of Canadian defined benefit pension plan sponsors, showed their median funded status stands at 96 per cent. The poll, A Confident Outlook revealed that nearly 25 per cent of respondents reported levels in excess of 100 per cent and only five per cent with funded levels of less than 70 per cent. Eighty-seven per cent of respondents remain confident they can meet their ongoing pension liabilities, which should be good news for the longevity of Canadian defined benefit pension plans.

“2017 was a strong year for Canadian pension plans, with year-over-year returns, despite a backdrop of ongoing global economic and political volatility,” said James Rausch, Head of Client Coverage, Canada, RBC Investor & Treasury Services. “The Bank of Canada rate hikes, the first in seven years, reverberated through the bond market, while the energy and commodity sectors continued to fluctuate and impact Canadian markets. Meanwhile, global equities continued to provide strong and stable returns. Fund managers will continue to pay close attention to these strong global returns and geopolitical developments to maintain a diversified portfolio across asset sectors and classes in the year ahead.”

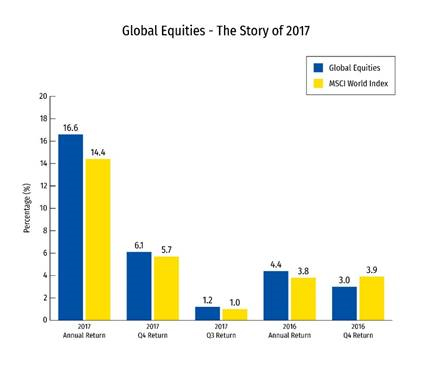

Continuing low interest rates, an uptick in the global economy, recovering emerging markets and improving labour markets helped fuel 2017 global equity returns.

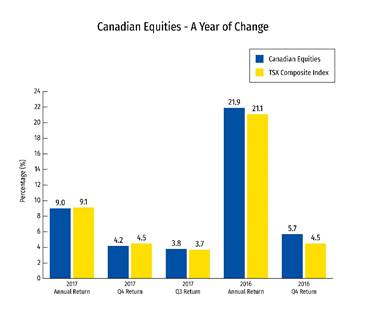

While the Canadian economy was a strong performer in 2017, and the Bank of Canada interest rate hike in September of 2017 boosted financial stocks in Q4, the energy sector weighed down year-over-year returns on the TSX. In 2016, however, Canada’s three largest sectors – energy, materials and financial services, posted strong results, helping lift returns.

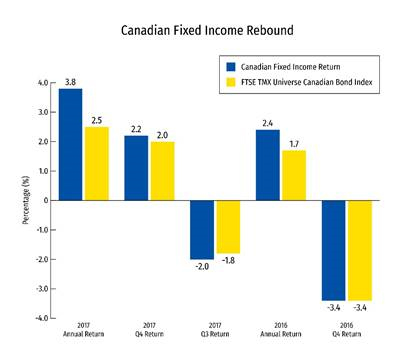

The RBC Investor & Treasury Services poll also revealed that 40 per cent of respondents identified low interest rates as their main concern in the year ahead.

In 2017, Canadian bond yields rose across most of the curve while the Bank of Canada’s interest rate hikes in July and September led to a flatter yield curve when compared to the start of the year.

HISTORIC PERFORMANCE

|

Period |

Return (%) |

Period |

Return (%) |

|

Q4 2017 |

4.4 |

Q4 2015 |

3.1 |

|

Q3 2017 |

0.4 |

Q3 2015 |

-2.0 |

|

Q2 2017 |

1.4 |

Q2 2015 |

-1.6 |

|

Q1 2017 |

2.9 |

Q1 2015 |

6.6 |

|

Q4 2016 |

0.5 |

Q4 2014 |

2.7 |

|

Q3 2016 |

4.2 |

Q3 2014 |

1.1 |

|

Q2 2016 |

2.9 |

Q2 2014 |

3.0 |

|

Q1 2016 |

0.0 |

Q1 2014 |

4.8 |