Tokyo Stock Exchange (TSE) is currently carrying out measures (hereinafter referred to as the “Growth Market Reform”) to establish the TSE Growth Market as a hub for companies aiming for high growth.1 In line with this, JPX Market Innovation & Research, Inc. (JPXI) has been preparing to provide a new index focused on the growth of startups.2

We are pleased to announce that we have now finalized the outline of the new “JPX Start-Up Acceleration 100 Index.” This index will primarily target stocks listed on the TSE Growth Market and select constituents based on growth criteria.

We will proceed with the detailed design and plan to commence distribution on Monday, March 9, 2026.

1. Objectives of Developing the JPX Start-Up Acceleration 100 Index

The establishment of an environment that facilitates investment in high-growth companies serve as an important foundation for companies to actively raise capital and make growth investments. In discussions on the Growth Market Reform promoted by TSE, there have also been expectations for indices that include companies achieving high growth, from the perspective of making it easier for investors to invest in attractive companies.

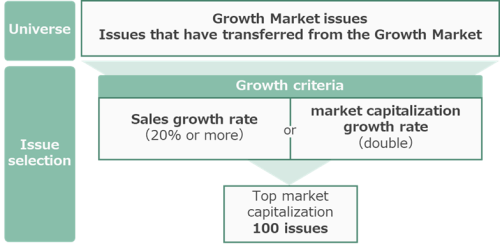

In light of these circumstances, JPXI has decided to develop a new stock price index, the "JPX Start-Up Acceleration 100 Index," composed of companies listed on the TSE Growth Market as well as those that have recently transferred from the TSE Growth Market to other markets. Companies selected for this index will be identified as "Japan’s leading high-growth startups," based on two indicators that measure the growth of startups: (1) sales growth rate and (2) market capitalization growth rate.

Through the "JPX Start-Up Acceleration 100 Index," we aim to create a virtuous cycle in which even more growth-oriented management is encouraged among startups and investment in those achieving growth is further expanded by promoting the use of the index composed of high-growth startups and investment in linked products such as ETFs.

2. Outline of JPX Start-Up Acceleration 100 Index

| Index name | JPX Start-Up Acceleration 100 Index |

| Concept | An index comprising Japan’s top high-growth startups |

| Issue selection method |

|

| Number of constituent issues | 100 |

| Calculation method | Free-float adjusted market capitalization-weighted |

| Constituent stocks & calculation methodology | Plan to publish calculation methodology, including component stocks and stock selection criteria, around February. |

| Planned distribution start date | Monday, March 9, 2026 |

| Calculation interval | Calculated and distributed in real time (every second) |

| Periodic review | Once a year (constituent review every July) |

- ・The index values will be posted on the JPX website along with the publication of the calculation methodology and constituent stocks.

- ・The above outline is current as of now and may be partially modified as we proceed with the detailed design.

3. Use of JPX Start-Up Acceleration 100 Index

A license agreement with JPXI is required when using the JPX Start-Up Acceleration 100 Index for structuring or offering financial products or providing them to third parties.

JPXI accepts license applications for ETFs based on this index as follows:

- License coverage area: Japan

- License application period: From December 12, 2025, to January 16, 2026

Contact (Regarding the outline of this index)

JPX Market Innovation & Research, Inc. Index Business Department

E-mail : index@jpx.co.jp

Contact (Regarding licensing related to this index)

JPX Market Innovation & Research, Inc. Client Services Department

E-mail : index-license@jpx.co.jp