News has just broken that Microstrategy (MSTR) has announced plans to offer $600 million in Convertible Senior Notes to buy bitcoin which has pushed bitcoin above the important psychological milestone of $50k.

“Microstrategy's plans to purchase a further $600 million in bitcoin marks the latest milestone in the growing trend of corporate and institutional adoption of bitcoin that is driving price to all time highs.”

“Whichever angle you look at it from - supply being cornered by treasuries and ETPs, the increasing odds on a US ETF after a Canadian breakthrough, or the prospects for DeFi - Bitcoin is clearly in the ascendancy as a store of value and medium for value transfer.”

“Perhaps Ruffer’s statement is the most elucidating - "Yes, it is a seemingly nonsensical asset – but one that makes absolute sense for how we see the world"

“This ongoing tightening of supply driven by significant purchases by corporations eying the long-term view comes at a time where friction for institutional investors to gain exposure to digital assets is rapidly reducing, creating a perfect storm for bitcoin price appreciation.”

As the news broke bitcoin climbed $1,000 to a high of $50,489 in under 15 minutes which was followed by an intense sell-off and dropped $1,718 which is bitcoin’s largest 5-min decline in dollar terms.

Institutional Awareness and Adoption of Bitcoin is Growing

2020 marked a significant tipping point for bitcoin and digital assets as institutional investors entered the markets. We saw numerous corporations and institutional investors disclose their investments in bitcoin and their reasons for buying bitcoin.

Having the likes of Tesla, Square, Ruffer, Paul Tudor Jones and countless other respected corporations and investors extol the virtues of bitcoin has brought a lot of institutional capital in from the sidelines. The common narrative mentioned by institutional investors is that bitcoin is a hedge against inflation. In other words, it is a digital gold for the digital age.

The recent $1.5 billion investment in Bitcoin by Tesla for use as a treasury reserve asset has further legitimised the inflation narrative and the 'store of value' use case for Bitcoin. In doing so it has made it much more likely other corporations will follow suit as it is harder to look foolish after one of the world's most successful entrepreneurs and innovative companies have made such a high profile commitment to Bitcoin.

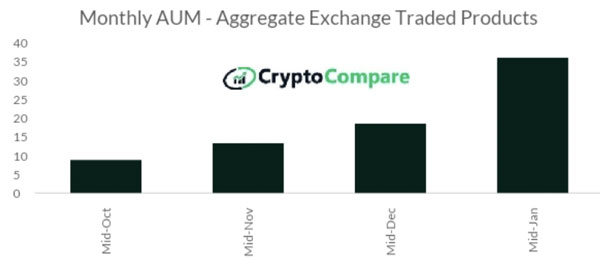

Behind the headline grabbing stories of big name corporations and investors buying bitcoin there are clear signs of growing institutional demand. Since mid-December 2020, total AUM across all ETPs have increased 95% to $35.96bn.

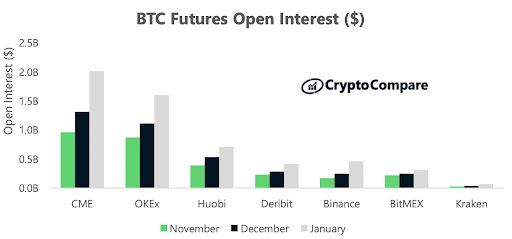

We have also seen CME Bitcoin Futures climb to the top spot in terms of open interest:

New products are being listed every week in leading stock exchanges across the world and U.S. SEC Commissioner Hester Peirce said during a recent interview that the U.S. market is ready for a Bitcoin ETP.

It is not only corporations that will be buying bitcoin this year. Miami mayor Francis Suarez says that his city is looking into “having and holding” a percentage of its treasury reserves in Bitcoin.

The idea of a central bank such as Swiss National Bank purchasing bitcoin may have seemed far fetched in 2019 but I would say it is not unlikely in 2021 given their forward thinking crypto regulatory policies and their adventurous and lucrative investments in tech stocks such as Tesla and Amazon.