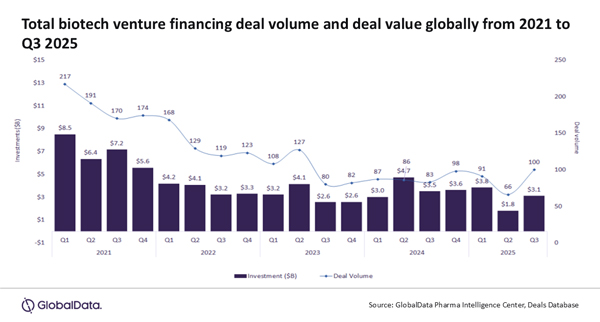

GlobalData’s Venture Capital Investment Trends In Pharma – Q3 2025 report reveals that the biotech industry witnessed a 70.9% increase in total venture financing deal value from $1.8 billion in Q2 2025 to $3.1 billion in Q3 2025. This uptick signals improving investor sentiment, reflecting renewed confidence in biotech innovation and growth prospects despite policy uncertainty, market headwinds, and recent funding constraints in the US, says GlobalData, a leading data and analytics company.

Biotech funding recovery was seen in 2024 fueled by interest rate cuts, with the trend continuing to Q1 2025. However, the return of the Trump administration in January 2025 contributed to a further challenging environment, as tariffs, drug pricing pressures, funding cuts to the National Institutes of Health (NIH) and layoffs at the FDA and CDC created market uncertainty.

Alison Labya, Senior Business Fundamentals Pharma Analyst at GlobalData, comments: “Despite the ongoing challenges stemming from Trump’s policies and economic headwinds, investor confidence increased in Q3 2025 amid an uptick in M&A activity, with a 36.7% increase in total deal value to $43.2 billion in Q3 2025 compared to the previous quarter, according to GlobalData’s M&A Trends in Pharma – Q3 2025 report.”

Furthermore, interest rate cuts by the US Federal Reserve announced in September 2025 has further boosted investor optimism, by lowering the cost of capital, which may facilitate greater venture capital investments in biotech.

Series D rounds of financing saw the highest growth compared to series A, B, C and E, rising 60-fold from Q2 2025 to a total of $832 million, according to GlobalData’s Pharmaceutical Intelligence Center Deals Database, indicating a shift in capital towards later stage growth and expansion investments in existing portfolio companies.

In August 2025, California-based Kriya Therapeutics secured $320 million in Series D venture financing towards its pipeline of gene therapies, the largest round of financing in Q3 2025.

In September 2025, Boston-based Odyssey Therapeutics raised $213 million in Series D venture financing towards the development of its targeted autoimmune drugs, including its TNFR2 agonist OD-00910, which has a planned Phase I trial in systemic lupus erythematosus, vitiligo and type 1 diabetes.

Labya concludes: “The biotech industry saw a resurgence in deal activity in Q3 2025, though investors remain selective. Sustained investor confidence heading into 2026 will depend on the ability of the biopharmaceutical sector to mitigate Trump’s tariffs and drug pricing pressures, as well as the US Federal Reserve’s continued commitment towards interest rate cuts.”

For further insights into the latest Deal Trends in the Pharma Sector, please see GlobalData’s Venture Capital Investment Trends In Pharma – Q3 2025 and M&A Trends in Pharma – Q3 2025 reports.

Note: Includes announced and completed venture financing deals involving companies headquartered globally with at least one biologic drug tagged to the deal, which were announced between 1 January 2021 and 30 September 2025, where a deal value has been publicly disclosed.