Biopharmaceutical drug company venture financing witnessed a year-on-year (YoY) 20.2% downturn from $8.1 billion during the first quarter (Q1) of 2024 to $6.5 billion in Q1 2025. This suggests that the biopharmaceutical venture financing environment remains challenging, mirroring a similar downturn seen in 2022 and 2023, with investors continuing to favor later-stage companies with clinical data, says GlobalData, a leading data and analytics company.

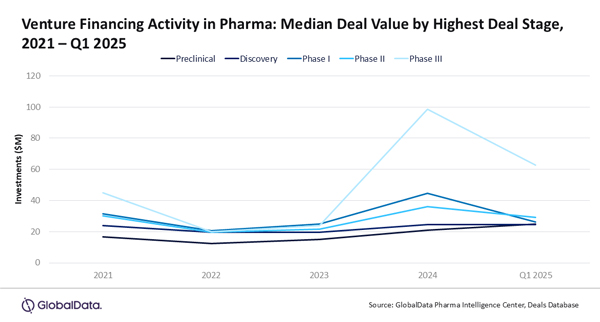

According to GlobalData’s Pharmaceutical Intelligence Center Deals Database, Phase III biopharmaceutical companies recorded the highest median deal value at $62.5 million in Q1 2025, marking a 38.9% increase from $45 million in 2021 despite a peak in overall venture financing activity that year.

Alison Labya, Business Fundamentals Pharma Analyst at GlobalData, notes: “The higher deal values for late-stage firms underscores a distinct realignment of investor risk appetite – a trend observed since 2024. Amid the ongoing macroeconomic uncertainty, venture capitalists are favoring opportunities with clearer routes to near-term revenue and market access over longer-horizon development risks.”

To view further insights into venture financing activity globally in Q1 2025 in the Pharma Sector, please see our Pharma Venture Capital Investment Trends – Q1 2025 report.

Note: Includes announced and completed venture capital deals and investments made by private equity firms involving biopharmaceutical companies with drugs headquartered globally which are announced between 1 January 2021 and 31 March 2025, where a deal value has been publicly disclosed.