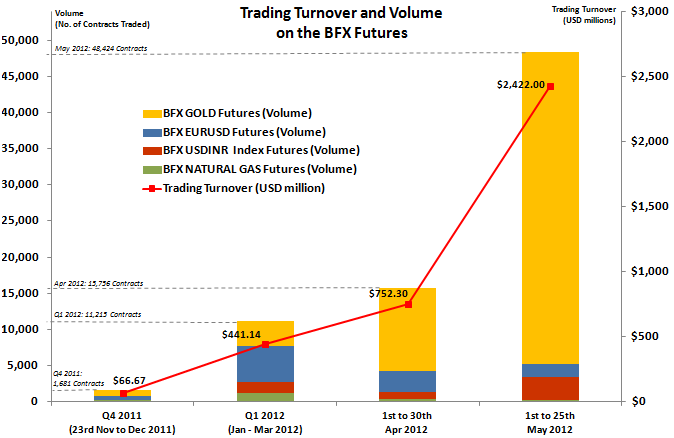

The Bahrain Financial Exchange (BFX), the first multi-asset international financial exchange in the Middle East and North Africa (MENA) region, proudly announces the successful completion of six months of trading on the BFX Futures markets with the cumulative (single-side) trading turnover on the BFX Futures increasing to USD 3.68 billion (for the period between 23rd Nov 2011 and 25th May 2012) – the cumulative trading volume reaching 77,076 contracts. The highest (single-side) daily trading turnover was USD 224.74 million, with a trading volume of 4,535 contracts achieved on the 16th of May 2012.

The BFX Gold Futures contract was the most actively traded contract in this period with its trading volume increasing to 59,065 contracts (total trading turnover of USD 3.03 billion; total quantity of approx. 1.89 million ounces equivalent to 58.79 metric tonnes).

The first USD 1 billion mark in cumulative trading turnover was achieved in 107 trading days; whereas, the next USD 1 billion mark in cumulative trading turnover was achieved in only 12 trading days, and the third USD 1 billion mark in just 7 trading days. Remarkably, the trading turnover of USD 3.35 billion during the second three-month period (from 24th Feb 2012 to 23rd May 2012) was 14 times the trading turnover of USD 0.237 billion during the first three-month period (from 23rd Nov 2011 to 22nd Feb 2012). The total trading turnover of the BFX Futures between the 1st and 25th of May 2012 (USD 2.42 billion) was nearly double the total trading turnover during the entire period between the 23rd of November 2011 and the 30th of April 2012 (USD 1.26 billion). The total end-of-day “Open Interest” on the BFX Futures has steadily increased to 400 contracts as on the 25th of May 2012, indicating an increase in participation on the BFX markets for carry forward positions.

Commenting on the occasion, Mr. Arshad Khan, Managing Director and Chief Executive Officer of the BFX and the BFX Clearing and Depository Corporation (BCDC), said: “Quadrupling the total trading volume from USD 1 billion to close to USD 4 billion in a period of one month reflects the immense opportunities the BFX has created for market participants. We take pride that in less than six months time, the BFX has achieved tight spreads in all the products, liquidity is increasing rapidly and prices are getting in line with the international markets. With these attributes firmly in place, the BFX Futures market can be more efficiently utilised for trading, investment and hedging purposes by the physical and financial industry of the region. Establishing such a market place in such a short time-frame underscores our commitment to position the BFX as the market of choice.”