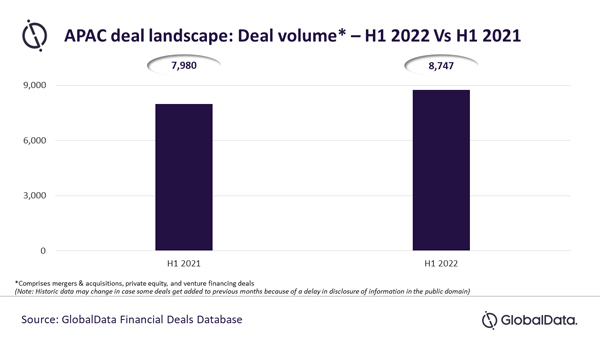

A total of 8,747 deals (mergers & acquisitions [M&A], private equity, and venture financing deals) were announced in the Asia-Pacific (APAC) region during the first half (H1) of 2022, which is an increase of 9.6% over the 7,980 deals announced during the H1 2021, according to GlobalData, a leading data and analytics company.

An analysis of GlobalData’s Financial Deals Database reveals that although deal activity has remained inconsistent throughout 2022, June reversed the month-on-month decline the APAC region has been witnessing since the onset of Q2.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “The growth in H1 2022 becomes even more significant despite China, which is the most prominent APAC market, witnessing a decline in deal activity. Meanwhile, several other key APAC markets showcased resilience to the prevailing market volatility and managed to register year-on-year (YoY) double-digit growth in deal activity in H1 2022.”

For instance, the number of deals announced in India, Japan, Australia, South Korea, Singapore, Indonesia and New Zealand increased by 34.9%, 17.9%, 2.9%, 27.9%, 27.6%, 31.3% and 16.1%, respectively, in H1 2022 compared to H1 2021.

However, China witnessed a decline in deal activity by 8.7% in H1 2022. Akin to China, Malaysia and Hongkong also witnessed a decline in deal activity during the period.

The number of M&A and venture financing deals increased by 2.2% and 19%, respectively, whereas the number of private equity deals decreased by 18.7% in H1 2022 compared to H1 2021.