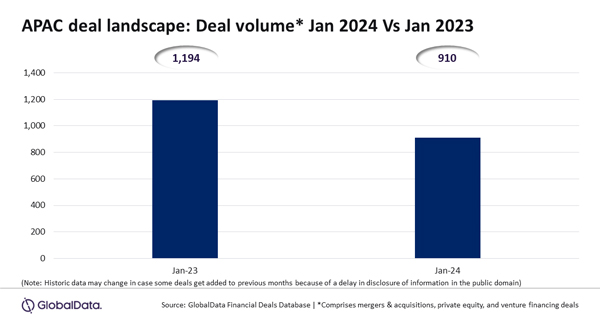

A total of 910 deals (mergers & acquisitions (M&A), private equity and venture financing deals) were announced in the Asia-Pacific (APAC) region during January 2024, which was a decline of 23.8% compared to the announcement of 1,194 deals during January 2023, according to GlobalData, a leading data and analytics company.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Deal activity remained subdued globally with all the regions experiencing decline in deals volume owing to the dent in deal-making sentiments amid the volatile market conditions. APAC region also saw decline, but it was relatively lesser compared all other regions.”

North America, Europe, the Middle East and Africa, and South and Central America witnessed year-on-year (YoY) decline in deal volume of 38.4%, 35.8%, 33%, and 52%, respectively, which are relatively higher compared to the decline experienced in the APAC region.

An analysis of GlobalData’s Deal Database revealed that all the deal types under the coverage recorded significant decline YoY in deal volume in the APAC region.

The number of M&A deals declined by 29.5% during January 2024 compared to the same period in the previous year while private equity and venture financing deals volume declined by 68.8% and 15.8%, respectively.

Meanwhile, most of the key APAC markets also experienced subdued deal activity. China and India, which are the top two APAC markets in terms of deal volume, registered decline of 20.9% and 33.9%, respectively.

Other markets Japan, South Korea, Australia, Malaysia, Hong Kong, Indonesia and Thailand witnessed YoY decline in deal volume by 25.5%, 16.7%, 6.8%, 23.5%, 25%, 46.4% and 41.2%, respectively.