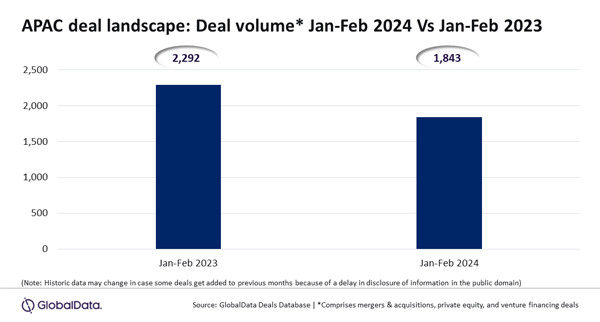

A total of 1,843 deals (mergers & acquisitions [M&A], private equity and venture financing deals) were announced in the Asia-Pacific (APAC) region during January-February 2024, which is a year-on-year (YoY) decline of 19.6% compared to the 2,292 deals announced during the same period in previous year, according to GlobalData, a leading data and analytics company.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “The deal activity trend for the APAC region was no different from other regions. In line with the global trend, all the deal types under coverage witnessed YoY decline in volume during January-February 2024.”

The number of M&A deals declined by 20.2% during January-February 2024 compared to the same period in 2023 while the volume of venture financing deals and private equity deals were down by 17.6% and 45.6% YoY, respectively.

Bose adds: “Again akin to the global trend, several key markets within the APAC region experienced subdued deal activity during the first two months of 2024.”

In fact, an analysis of GlobalData’s Deal Database reveals that all the top 10 APAC markets in terms of the number of deals announced during January-February 2024 experienced decline in volume.

The top 10 APAC markets China, India, Japan, Australia, South Korea, Singapore, Malaysia, Hong Kong, Indonesia and Thailand witnessed YoY decline in deal volume by 23%, 12.9%, 23.5%, 3.2, 12.2%, 13.2%, 32.4%, 28.3%, 38.1%, and 28.6%, respectively, during January-February 2024.

Bose concludes: “In a challenging global landscape, the decline in deal activity across the Asia-Pacific region underscores the need for resilience and adaptability within the market. While these figures may reflect short-term fluctuations, they also present opportunities for strategic recalibration and innovation to drive sustainable growth in the future.”