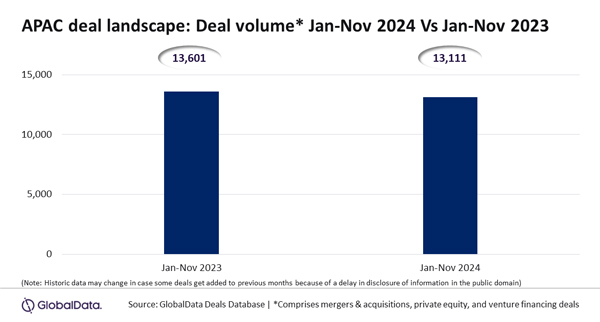

A total of 13,111 deals (mergers & acquisitions (M&A), private equity and venture financing) were announced in the Asia-Pacific (APAC) region during January-November 2024 period, which represents a decline of 3.6% compared to the 13,601 deals announced during the same period in 2023, according to GlobalData, a leading data and analytics company.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “In line with the global trend wherein all regions experienced subdued deal activity, APAC region also registered decline in deal volume. However, the decline is relatively much lesser compared to other regions. In fact, it was the lowest among all the regions. Even though the top APAC market, China registered massive double-digit decline, it was offset to some extent by the improvement showcased by some other markets in the region.”

An analysis of GlobalData's Deals Database reveals that the number of deals announced in China declined by 21.9% during January-November 2024 compared to January-November 2023. Singapore, Malaysia, Hong Kong, and Indonesia were also among the APAC markets that witnessed decline and these countries experienced respective deal volume fall by 15%, 11.4%, 11.3% and 35.4% during the review period.

Meanwhile, India, Japan, Australia, South Korea and Thailand were some of the leading economies that witnessed improvement in deal volume by 11.7%, 27.9%, 3.2%, 4.1% and 8%, respectively, during January-November 2024 compared to similar months in 2023.

The trend across different deal types also remained a mixed bag for the APAC region. While M&A deals volume improved by 2.6% during January-November 2024 compared to January-November 2023, the number of private equity and venture financing deals declined by 11.8%, and 9.8% YoY, respectively.