- 112.1 Euro billion of total assets under management monitored at end of December 2013, up from 109 Euro billion at end of 3Q 2013;

- Alternative UCITS inflows in 4Q 2013: +2 Euro billion, Single managers; -89 Euro million, Fund of funds: Long/short equity and Credit long/short strategies are responsible for the growth of the sector: +3.3 Euro billion and +1 Euro billion of inflows in 4Q 2013.

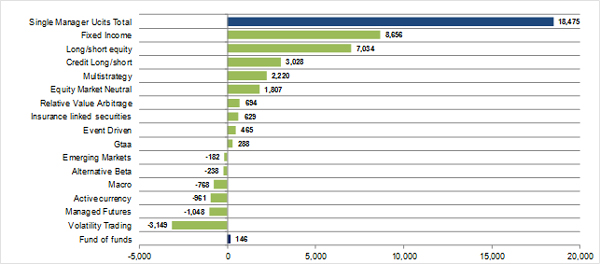

- Fixed income (8.7 Euro billion), Long/short equity (7 Euro billion) and Credit long/short (3 Euro billion) are the top three strategies by assets flows in 2013 (see chart 1)

Flows into alternative single manager UCITS funds in 2013.

Data in Euro millions. Source: MondoAlternative. Chart 1

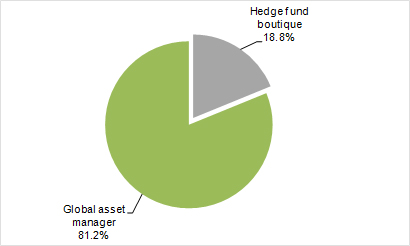

Alternative UCITS funds continue to grow and registered positive inflows during the fourth quarter of 2013, bringing the 2013 inflows to the record level of 18.5 Euro billion for single manager products, and funds of funds to just +146 Euro million. According to the new MondoAlternative quarterly report, daily funds gathered the most in the fourth quarter, +1.2 Euro billion, and also during the entire 2013 (+15.1 Euro billion), thus representing the 80.1% of the sector. Global asset managers (defined as companies managing hedge funds and other types of investments) continue to run, being responsible for over 1 billion Euro of inflows in the fourth quarter and 16 Euro billion in 2013. Hedge fund boutiques (companies managing exclusively hedge fund strategies) registered inflows in the fourth quarter (+917 Euro million), and also during the whole 2012 (+2.4 Euro million). They represent the 18.8% of the total assets of the industry (see chart 2).

Stefano Gaspari, chief executive officer of MondoAlternative says: “After the first six months of 2013, when investors were attracted by alternative investments in the Fixed income space, there was a complete reversal in June and flows were directed to equity strategies, as also experienced by traditional long only investments. Combined, Long/short equity and Equity market neutral funds attracted 8.8 Euro billion. The low volatility environment harmed Volatility trading products, who registered strong outflows, as also happened to Managed futures funds, that generally posted disappointing results caused by trend reversals and whipsaws movements in different asset classes, especially in commodities. For the year to come”, Gaspari continues, “we expect a continued interest for Equity hedged strategies in the first months, especially for those funds with low market exposure that will be able to better navigate during markets sell-offs. Market neutral strategies, relative value and Macro products are set to attract investors should the macroeconomic environment be less influenced by Central Banks intervention”.

Alternative single manager UCITS funds: type of managers

Source: MondoAlternative. A global asset manager is defined as a company managing hedge funds and other types of investments; a hedge fund boutique is a company managing exclusilvely hedge fund strategies. Chart 2

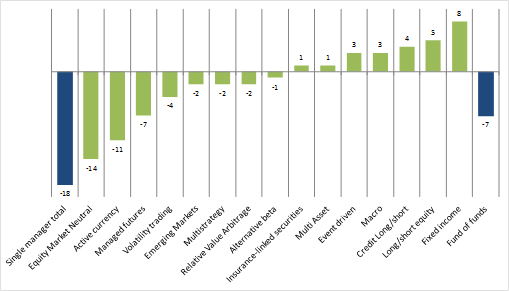

“Speaking of flows, the interesting fact is that in 2013, small and mid-sized funds showed the strongest positive net flows: +4.4 Euro billion went to funds with less than 100 Euro million, +6.2 Euro billion into funds from 100 to 250 Euro million. Funds between 500 and 1,000 million Euro were hit by outflows (-4.5 Euro billion), while gathering 4.8 Euro billion of inflows, thus bringing the net result to a small positive data of +0.3 Euro billion over the year” (see chart 3).

Single manager Alternative UCITS: 2013 flows* by funds’ AUM

* Estimated data in Euro million. Funds’ AUM is referred to the end of 2012. Source: MondoAlternative. Chart 3

Deeply looking at Long/short equity products, flows were mainly directed to European focused funds. “Long/short equity Europe products (41.3% of L/S equity funds) attracted 58.8% of the flows into the Long/short equity space, followed by US focused funds (15 products out of 109), that attracted 16.4% of the flows, and by UK focused funds (10 products, or 9.2%), that attracted 13% of the flows. Global long/short equity funds (22.9% of the sector) just attracted 9.4% of the flows”, Gaspari observes.

“During the fourth quarter of 2013, there was a run-up in new funds launches. According to our data, 22 new funds were launched and 20 were liquidated, mainly due to poor performance or to a low level of assets. Despite that, the year ended with a negative balance: 89 products were shut down, while 64 new funds were launched (see chart 4)”, Gaspari ends.

New fund launches - liquidations balance in 2013

Source: MondoAlternative. Chart 4

Focus on the Italian market

- At the end of December, of the 475 alternative UCITS funds monitored by MondoAlternative, 313 are authorized for sale in Italy.

- In Italy, 22 Asset management companies manage 34 single manager products and 8 funds of alternative UCITS funds, for a total AUM equal to 4.6 Euro billion, registering a growth of 500 Euro million in 4Q 2013.

- Anima Star High Potential Europe (Long/short equity) is the biggest single manager fund with 624 Euro million, followed by Anima Star Europa Alto Potenziale (507 Euro million, Long/short equity) and AZ Fund 1 - Cat Bond (377.3 Euro million, Long/short equity) at the end of December 2013.

- Anima Flex 50 leads the Fund of funds ranking by AUM, with 383.5 Euro million, followed by Kairos International Sicav Multi Strategy Ucits (231 Euro million) and Tages Capital Sicav Global Alpha Selection (106.8 Euro million) at the end of December 2013.

Other findings of the report

- Fixed income (30.3 Euro billion), Long/short equity (20.3 Euro billion) and Equity market neutral (10 Euro billion) are the top three strategies by assets managed;

- +1.92% performance (Equal Weighted Index) in 4Q 2013 for single managers (+1.35% Asset weighted Index), 2013 performance at +3.69% (Equal Weighted Index) and +1.96% (Asset Weighted Index),while during the year 3 months Libor performed +0.14%;

- +2.11% performance (Equal Weighted Index) in 4Q 2013 for funds of funds, +2.08% (Asset weighted Index); 2013 performance at +4.85% (Equal Weighted Index) and +4.28% (Asset weighted Index);

- 26 Asset managers with more than 1 Euro billion in alternative UCITS funds assets represent the 71.3% of the industry.

Alternative UCITS Funds - 4th quarter 2013 update 2013 review