- Alternative UCITS inflows in 3Q 2013: +3.2 Euro billion, Single managers; +93 Euro million, Fund of funds

- 109 Euro billion (end of September 2013) of total assets under management monitored, up from 103.7 Euro billion at end of June 2013;

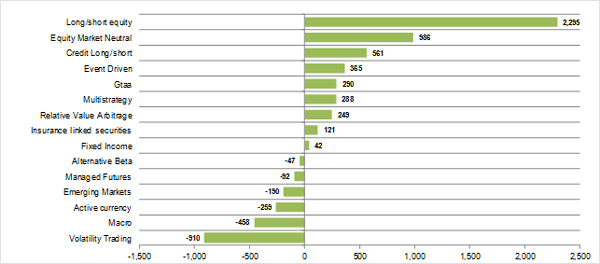

- Long/short equity and Equity market neutral strategies are responsible for the growth of the sector: +2.3 Euro billion and +986 Euro millions of inflows respectively in 3Q 2013 (see chart 1).

Flows into alternative single manager UCITS funds in 3Q 2013.

Data in Euro millions. Source: MondoAlternative. Chart 1

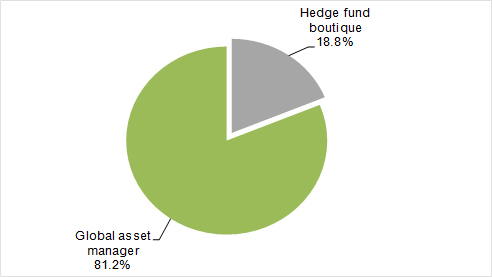

The growth of alternative UCITS funds keeps on: +3.2 Euro billion of fresh new money entered the segment. According to the new MondoAlternative quarterly report, daily funds gathered the most in the third quarter, +2.7 Euro billion, thus representing the 80.4% of the industry. Global asset managers (defined as companies managing hedge funds and other types of investments) continue to run, being responsible for over 2.2 Euro billion of inflows in the third quarter, and hedge fund boutiques (companies managing exclusively hedge fund strategies) also recorded strong inflows in 3Q 2013 (+1.1 Euro billion). Their market share is up at 18.8% (Global asset managers stand at 81.2%, see chart 2)

Stefano Gaspari, CEO at MondoAlternative says: “The favorable conditions for equity investments, with a strict control over possible drawdowns like what happened in June and then in August, supported the strong inflows registered in just two months by alternative UCITS funds focused on Equity hedged strategies. The biggest contributors to the growth of the sector, in fact, were Long/short equity and Equity market neutral funds, who, combined, attracted 3.3 Euro billion. The low volatility environment and asset prices moves driven by Central banks decisions that are difficult to forecast, harmed Volatility trading and Macro products, who registered outflows over July and August. For the coming months”, Gaspari continues, “we expect a continued interest for Equity hedged strategies, especially for those focused on Europe, as well as for flexible and actively managed multi asset products”.

Alternative single manager UCITS funds: type of managers

Source: MondoAlternative. A global asset manager is defined as a company managing hedge funds and other types of investments; a hedge fund boutique is a company managing exclusilvely hedge fund strategies. Chart 2

“As already happened during the second quarter of 2013, also in the third quarter there was a slowdown in new funds launches. According to our data, 10 new funds were launched and 23 were liquidated, mainly due to poor performance or to a low level of assets. The industry is growing in asset under management terms, and the big funds are growing at a faster pace: the number of investment houses managing over 1 Euro billion in Alternative UCITS is stable at 26 for a total of 78 Euro billion under management, a 71.6% share of the entire industry”.

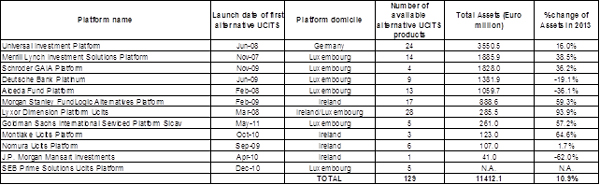

Exclusive survey

According to a survey made by the MondoAlternative Research Department over 12 UCITS platforms managing more than 11.4 Euro billions in alternative UCITS at the end of August 2013, the biggest structure is Universal Investment Platform with 3.6 Euro billion of assets, followed by Merrill Lynch Investment Solutions Platform (1.9 Euro billion) and Schroder GAIA Platform (1.8 Euro billion). Overall, Alternative UCITS platforms have grown by 10.9% in the first eight months of 2013 (see table 1)

Alternative UCITS platforms

Data updated end of August 2013. Source: MondoAlternative. Table 1

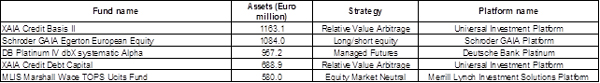

Looking at funds, the biggest 5 products manage 4.5 Euro billion. Top alternative UCITS fund by assets present on a platform is XAIA Credit Basis II with close to 1.2 Euro billion, followed by Schroder GAIA Egerton European Equity (1.1 Euro billion) and DB Platinum IV dbX systematic Alpha (957 Euro million, see table 2).

Top 5 funds on alternative UCITS platforms

Data updated end of August 2013. Source: MondoAlternative. Table 2

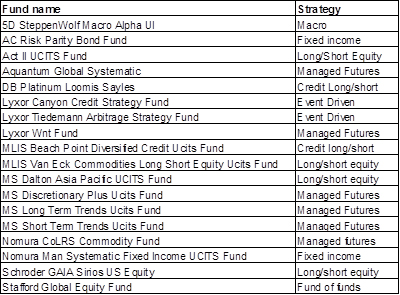

New fund launches on alternative UCITS platforms in 2013

As what concerns new products, 18 funds were launched over the first eight months of 2013, of which 6 are Managed futures funds and 4 are Long/short equity funds. The new funds launched in 2013 are worth 712 Euro million of Assets under management. Morgan Stanley Fundlogic Alternatives Platform has been the most active platform, launching 4 new products (see table 3). It must be underlined that in eight months, 15 funds have been liquidated.

Alternative UCITS start up on platforms

Data updated end of August 2013. Source: MondoAlternative. Table 3

Focus on the Italian market

- At the end of September, of the 504 alternative UCITS funds monitored by MondoAlternative, 332 are authorized for sale in Italy.

- In Italy, 21 Asset management companies manage 34 single manager products and 8 funds of alternative UCITS funds, for a total AUM equal to 4.1 Euro billion, registering a growth of 200 Euro million in 3Q 2013.

- Anima Star Europa Alto Potenziale (Long/short equity) is the biggest single manager fund with 459 Euro million, followed by Anima Star High Potential Europe (456.9 Euro million, Long/short equity) and Kairos International Sicav Selection Class P (317.7 Euro million, Long/short equity) at the end of September 2013.

- Anima Flex 50 leads the Fund of funds ranking by AUM, with 378.4 Euro million, followed by Kairos International Sicav Multi Strategy Ucits (171.9 Euro million) and Tages Capital Sicav Global Alpha Selection (109.3 Euro million) at the end of September 2013.

Other findings of the report

- Fixed income (30.3 Euro billion), Long/short equity (16.3 Euro billion) and Equity market neutral (9.6 Euro billion) are the top three strategies by assets managed at the end of September 2013;

- +2.7 Euro billion daily funds, +514 Euro million weekly funds, +73 Euro million fortnightly funds at the end of September 2013;

- +0.94% performance (Equal Weighted Index) in 3Q 2013 for single managers (+0.44% Asset weighted Index), YTD performance at +1.74% (Equal Weighted Index) ,during the same period 3 months Libor performed +0.04%;

- +1.46% performance (Equal Weighted Index) in 3Q 2013 for funds of funds, +1.32% (Asset weighted Index);