On Tuesday, January 17, 2017, the African Development Bank (AfDB), rated Aaa / AAA/ AAA by Moody’s / S&P / Fitch (all stable), successfully launched a EUR 1 billion 7-year Benchmark transaction due January 24, 2024. The issue priced at 3 bps through Mid-Swaps, equivalent to a spread of 45.5 bps over the DBR 1.750% February 2024. This represents AfDB’s first ever 1 billion EUR benchmark transaction following from its debut EUR 10-year issue in October last year. Despite a heavy week of supply in the Supra, Sovereign and Agency space, AfDB took advantage of a short window of execution ahead of the ECB meeting on Thursday to bring this successful transaction to market.

Final terms of the transaction

|

Issuer |

African Development Bank, rated Aaa / AAA/ AAA (Moody’s / S&P / Fitch) |

|

Principal Amount |

EUR 1,000,000,000 |

|

Pricing Date |

January 17, 2017 |

|

Settlement Date |

January 24, 2017 |

|

Maturity Date |

January 24, 2024 |

|

Re-Offer Price/Yield |

99.709% / 0.292% |

|

Coupon |

0.250% |

|

Spread vs. MS |

-3bps |

|

Spread vs. DBR 1.750% February 2024 |

+45.5bps |

|

Denominations |

EUR 1,000 |

|

Documentation |

Issuer’s Global Debt Issuance Facility |

|

Listing |

Luxembourg Stock Exchange (Regulated Market) |

|

ISIN |

XS1555080198 |

|

Joint Bookrunners |

Barclays, Crédit Agricole CIB, Natixis, NatWest |

Launch and execution process

- The issue was announced on Monday, January 16 at 3:45 p.m. London time on the back of supportive market conditions and despite uncertainty surrounding Theresa May’s press conference on Tuesday on Brexit details.

- Initial Pricing Thoughts for a EUR 7-year Benchmark were released at Mid-Swaps minus 3 bps area on Tuesday, January 17 at 8:00 a.m.

- Books opened at 9:30 a.m. London time at a spread of Mid-Swaps minus 3 bps, with indications of interest already in excess of EUR 550 million from high quality investors. Momentum continued into the morning with the book growing above EUR 700 million by 11 a.m. at which time spread was set at Mid-Swaps minus 3 bps.

- Books closed at 12:00 p.m. London time, in excess of EUR 1.1 billion with very strong support from real money accounts across regions and soon after the transaction was launched with a EUR 1 billion size at Mid-Swaps minus 3 bps.

- The second EUR benchmark transaction issue from the African Development Bank was priced at 4:00 p.m. London time with a spread of Mid-Swaps minus 3 bps in line with guidance, equivalent to a spread over the DBR 1.750% February 2024 of 45.5 bps.

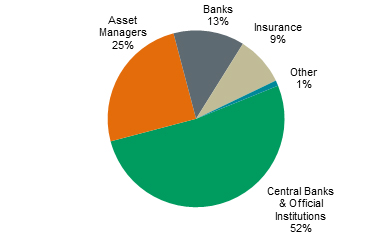

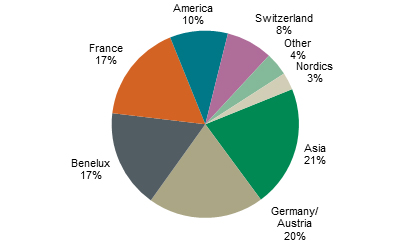

- With respect to investor type breakdown, Central Banks and Official Institutions took the largest share (52%), followed by Asset Managers (25%), Banks (13%), Insurance (9%) and Others (1%). By geography, Asian accounts led with 21%, followed by Germany/Austria (20%), Benelux (17%), France (17%), America (10%), Switzerland (8%), Others (4%) and Nordics (3%).

“This is the first step for establishing the AfDB as a regular issuer in the Euro capital markets. We have been very active in the US dollar space, but given the growth of our funding program in recent years (USD 9 billion dollars for 2017) we are actively diversifying our sources of funds,” said AfDB Treasurer, Hassatou N’Sele.

Distribution stats

|

|