On the occasion of London Climate Action Week, Clarity AI, the leading global sustainability technology company, has released new research on climate progress among the world’s most carbon-intensive companies in the steel and cement sectors. Despite representing approximately 15% of global CO₂ emissions and widespread commitments to reduce their environmental impact, most of these companies remain far behind in achieving meaningful decarbonization.

The analysis, which assessed 50 of the highest-emitting companies globally, reveals a growing disconnect between commitments and actual results. While more than 70% of companies have set emissions reduction goals, none of the steel companies analyzed are aligned with the IEA’s Net Zero Emissions (NZE) pathway, and fewer than 40% are on track to meet even their own targets. In the cement sector, emissions have remained flat since 2018, and carbon intensity has improved by just 8% since 2019, —well below the IEA’s NZE scenario, which requires annual CO₂ intensity reductions of approximately 4% through 2030.

These findings highlight a widening gap between ambition and execution—raising critical concerns for investors, policymakers, and other stakeholders seeking to understand which companies are truly prepared for a low-carbon economy.

Companies pulling key levers show 9% lower emissions and a 14-year head start

To evaluate how companies are turning targets into action, Clarity AI used a proprietary framework that combines emissions data with advanced large language models (LLMs) to assess the credibility of transition plans. This framework evaluates both climate performance and the implementation of key decarbonization levers, including—among others—Electric Arc Furnaces (EAFs) or hydrogen-based reduction in steel, and clinker substitution or carbon capture in cement.

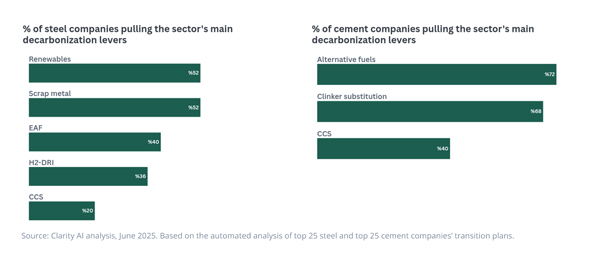

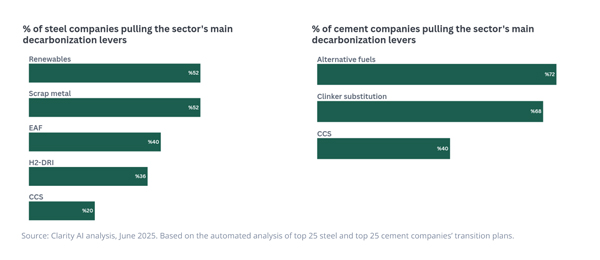

In the steel sector, scrap metal use and renewable electricity are commonly cited strategies. EAFs are mentioned by 40% of companies, hydrogen-based reduction by 36%, and CCS by just 20%. Despite limited disclosure, early evidence suggests that companies deploying these levers are ahead of their peers. Notably, steel producers using EAFs show carbon intensities that are 9% lower than those who do not, equivalent to a 14-year head start at current decarbonization rates.

In the cement sector, the most frequently referenced decarbonization levers are alternative fuels (cited by 72% of companies) and clinker substitution (68%). However, only 40% mention Carbon Capture and Storage (CCS)—despite its importance for long-term emissions reduction. Still, early patterns are emerging: companies with lower clinker-to-cement ratios tend to have lower carbon intensities. CCS is still at an early stage, but those beginning to implement it already show faster decarbonization.

.jpg)

“While many companies mention decarbonization levers, most do not quantify their actions. Disclosure of operational timelines, investment figures, or deployment scale is still uncommon. This lack of detail makes it difficult for investors, regulators, and other stakeholders to separate meaningful transition strategies from superficial claims”, said Nico Fettes, Climate Research Director at Clarity AI.

84% of reports included data on climate levers, while only 74% reported emissions metric

The study also finds that data on decarbonization levers is more consistently reported than basic emissions data. Lever-related disclosures appeared in 84% of company reports, compared to just 74% for emissions metrics.

This gap suggests increased recognition of the importance of decarbonization strategies, but also exposes a lack of quantitative information.

“Evaluating transition plans is no longer optional—it’s essential. Emissions data alone doesn’t tell the full story. What really matters is whether companies are taking concrete steps today to achieve their long-term goals”, said Fettes, at Clarity AI.

For more information on Clarity AI and to download the full whitepaper please visit: https://clarity.ai