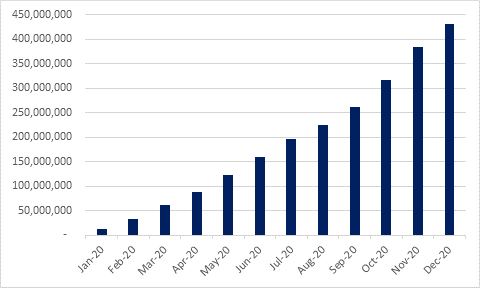

- The average growth rate of securitised derivatives traded in 2020 was 18% (MoM).

- In Q4 2020 170 million securitised derivatives were traded, marking a new high and an almost tenfold increase compared to Q4 2019.

- The average share of out-of-hours trading in 2020 (i.e. 1730-0900) was 38.7%.

Spectrum Markets has reported figures for its first full calendar year of trading, which reveal a strong performance in 2020 with a total of 431 million securitised derivatives traded and 1,535,016 executed trades. The average growth rate of securitised derivatives traded in 2020 was 18% (MoM). On an annual basis, the average share of out-of-hours trading (i.e. 1730-0900) was 38.7%.

The breakdown of trading volume of securitised derivatives is as follows: 85.7% is attributable to indices, 8.7% to FX and 5.6% to commodities. The top traded underlyings were the OMX with a share of 21.5%, followed by the S&P (21.3%) and the DAX (20.4%).

Despite the global economic uncertainty in 2020, Spectrum Markets grew significantly. The business started strongly in Q1 2020 with a plus of 250% in trading volume compared to Q4 2019, the first full quarter of trading. The trading volume continued to increase in every quarter. In Q2 2020 alone it rose by 63%. In Q4 2020, Spectrum Markets achieved an almost tenfold increase in its trading volume compared to Q4 2019.

Nicky Maan, CEO of Spectrum Markets, said: “2020 will be remembered as one of the most challenging years in history, both economically and socially. At the same time, it also marks the first full calendar year of Spectrum Markets’ history. I am very proud of how we as an organisation have handled the ever-changing situation.

“We started in 2019 with the aim of disrupting the world of securitised derivatives trading, with a clear focus on ensuring no compromises were made when it came to the needs and requirements of modern retail investors. We have proven that reliability and innovation can go hand in hand, as is seen through our rapid growth throughout the last year. We expect to continue the same level of success in 2021 – a year in which we will continuously improve our offering for issuers, market makers as well as for brokers and their retail investors. In addition, we are looking forward to welcoming new members onto our venue.”

Overview of cumulative securitised derivatives traded per month in 2020

Source: Spectrum Markets