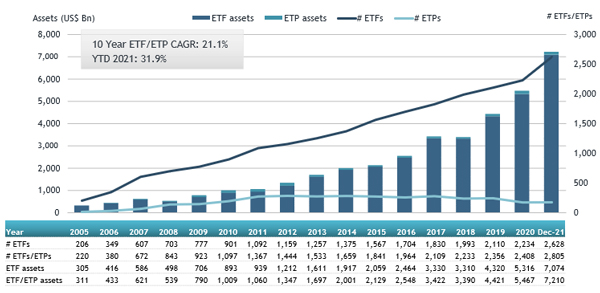

ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reports the ETFs industry in the United States ended 2021 with record high assets of US$7.21 trillion and record net inflows of US$919.78 billion. ETFs and ETPs listed in US gained net inflows of US$116.38 billion during December, bringing year-to-date net inflows to a record US$919.78 billion. Assets invested in the US ETFs/ETPs industry increased by 3.5% in December and 31.9% during 2021, according to ETFGI's December 2021 United States ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- ETFs industry in the United States ends 2021 with record high assets of $7.21 Trillion.

- Assets increased 31.9% in 2021, going from US$5.47 Tn at end of 2020, to US$7.21 Tn.

- Record net inflows in 2021 of $919.78 Bn beating the prior record of $490.19 Bn gathered in 2020.

- 2021 net inflows of $919.78 Bn are $429.59 Bn or 114% larger than 2020 record net inflows $490.19 Bn.

- 28th month of consecutive net inflows.

- The top 3 providers, account for 78.5% of assets. iShares $2.466 Tn, 34.2% market share; Vanguard $2.08 Tn and 28.8%, followed by SPDR ETFs with $1.11 Tn and 15.4% market share.

- Top 3 for net inflows in 2021: Vanguard $327.85 Bn, iShares US$212.68 Bn and SPDR ETFs US$97.53 Bn.

- Equity ETFs gathered a record $641.48 Bn in net inflows 2021.

“The S&P 500 increased 4.48% in December and was up 28.71% in 2021. Developed markets excluding the US, experienced a gain of 4.89% in December an was up 11.38% in 2021. Luxembourg (Up 12.65%) and Ireland (Up 9.68%) experienced the largest gains among the developed markets in December. Emerging markets were up 1.60% during December and gained 1.22% in 2021. Mexico (up 12.80%) and Czech Republic (up 12.55%) gained the most among emerging markets in December, whilst Chile (down 5.26%) and China (down 2.73%) witnessed the largest declines.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Growth in US ETF and ETP assets as of the end of December 2021

The ETFs/ETPs industry in the United States had 2,805 products, assets of $7.21 trillionn, from 234 providers listed on 3 exchanges.

During December 2021, ETFs/ETPs gathered net inflows of $116.38 Bn. Equity ETFs/ETPs listed in US gained net inflows of $90.29 Bn during December, bringing net inflows for 2021 to $641.48 Bn, much higher than the $205.92 Bn in net inflows equity products had attracted in 2020. Fixed income ETFs/ETPs reported net inflows of $20.33 Bn during December, bringing net inflows for 2021 to $174.43 Bn, slightly lower than the $176.40 Bn in net inflows fixed income products had attracted in 2020. Commodities ETFs/ETPs reported net outflows of $2.18 Bn during December, bringing year to date net outflows for 2021 to $11.35 Bn, while in 2020 commodities products attracted net inflows of $38.99 Bn. Active ETFs/ETPs gathered net inflows of $5.82 Bn during December, bringing net inflows for 2021 to $102.06 Bn, nearly double the $59.80 Bn in net inflows active products reported in 2020.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $71.64 Bn during December. SPDR S&P 500 ETF Trust (SPY US) gathered $25.58 Bn the largest individual net inflow.

Top 20 ETFs by net new assets December 2021: US

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

SPDR S&P 500 ETF Trust |

SPY US |

460,638.99 |

40,474.20 |

25,578.80 |

|

iShares Core S&P 500 ETF |

IVV US |

333,122.97 |

31,951.66 |

5,406.49 |

|

Invesco QQQ Trust |

QQQ US |

215,953.41 |

22,852.64 |

5,049.32 |

|

Vanguard Total Stock Market ETF |

VTI US |

296,642.01 |

43,368.58 |

4,473.21 |

|

Vanguard FTSE Developed Markets ETF |

VEA US |

110,104.52 |

16,054.74 |

3,487.81 |

|

iShares iBoxx $ High Yield Corporate Bond ETF |

HYG US |

21,698.93 |

(4,038.06) |

3,012.61 |

|

iShares 20+ Year Treasury Bond ETF |

TLT US |

19,667.08 |

1,886.31 |

2,987.59 |

|

Vanguard FTSE Emerging Markets ETF |

VWO US |

81,071.34 |

11,362.50 |

2,373.02 |

|

iShares Core S&P Small-Cap ETF |

IJR US |

75,280.44 |

5,504.59 |

2,007.33 |

|

Vanguard Total International Stock Index Fund ETF |

VXUS US |

53,016.13 |

12,974.65 |

1,894.97 |

|

Financial Select Sector SPDR Fund |

XLF US |

44,071.59 |

9,636.25 |

1,754.16 |

|

iShares Core U.S. Aggregate Bond ETF |

AGG US |

92,152.84 |

9,846.97 |

1,749.03 |

|

iShares iBoxx $ Investment Grade Corporate Bond ETF |

LQD US |

38,988.42 |

(14,114.85) |

1,699.72 |

|

iShares Core MSCI EAFE ETF |

IEFA US |

104,267.62 |

13,767.19 |

1,614.77 |

|

iShares Core MSCI Total International Stock ETF |

IXUS US |

32,858.80 |

6,347.11 |

1,534.55 |

|

ProShares UltraPro QQQ |

TQQQ US |

20,642.25 |

1,117.66 |

1,499.32 |

|

Vanguard Total Bond Market ETF |

BND US |

84,187.04 |

18,702.91 |

1,497.30 |

|

iShares Russell 1000 Value ETF |

IWD US |

59,972.31 |

5,681.31 |

1,430.76 |

|

iShares TIPS Bond ETF |

TIP US |

38,838.96 |

12,098.78 |

1,314.28 |

|

Vanguard Short-Term Inflation-Protected Securities Index Fund |

VTIP US |

19,714.89 |

9,933.64 |

1,272.42 |

The top 10 ETPs by net new assets collectively gathered $743 Mn during December. Invesco DB US Dollar Index Bullish Fund (UUP US) gathered $201.16 Mn the largest individual net inflow.

Top 10 ETPs by net new assets December 2021: US

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

Invesco DB US Dollar Index Bullish Fund |

UUP US |

717.31 |

328.58 |

201.16 |

|

iPath Bloomberg Commodity Index Total Return ETN |

DJP US |

1,013.78 |

328.01 |

168.44 |

|

ProShares Ultra VIX Short-Term Futures |

UVXY US |

816.76 |

1,675.82 |

129.73 |

|

ProShares Ultra DJ-UBS Natural Gas |

BOIL US |

173.51 |

72.73 |

71.91 |

|

MicroSectors FANG Innovation 3X Leveraged ETN |

BULZ US |

343.06 |

314.68 |

66.42 |

|

SPDR Gold MiniShares Trust |

GLDM US |

4,355.30 |

505.02 |

32.13 |

|

ProShares Short VIX Short-Term Futures |

SVXY US |

423.84 |

(197.38) |

28.01 |

|

iPath Shiller CAPE ETN |

CAPE US |

494.53 |

120.67 |

19.46 |

|

Aberdeen Standard Physical Silver Shares |

SIVR US |

995.15 |

274.75 |

13.05 |

|

MicroSectors US Big Banks Index 3X Leveraged ETN |

BNKU US |

136.46 |

40.33 |

12.36 |

Investors have tended to invest in Equity ETFs and ETPs during December.